How to Use the Strike x Price Report

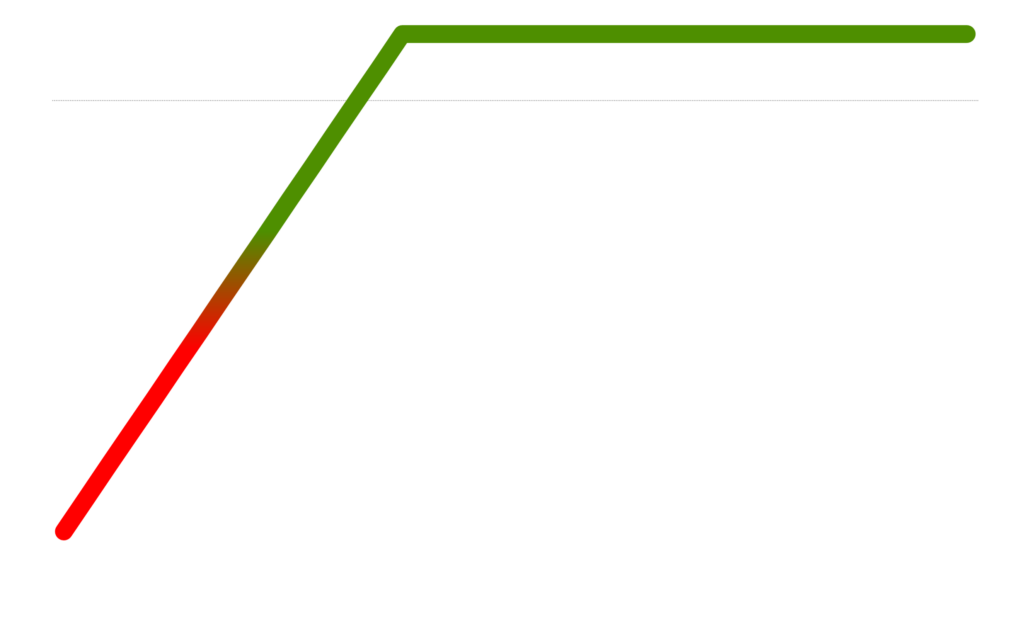

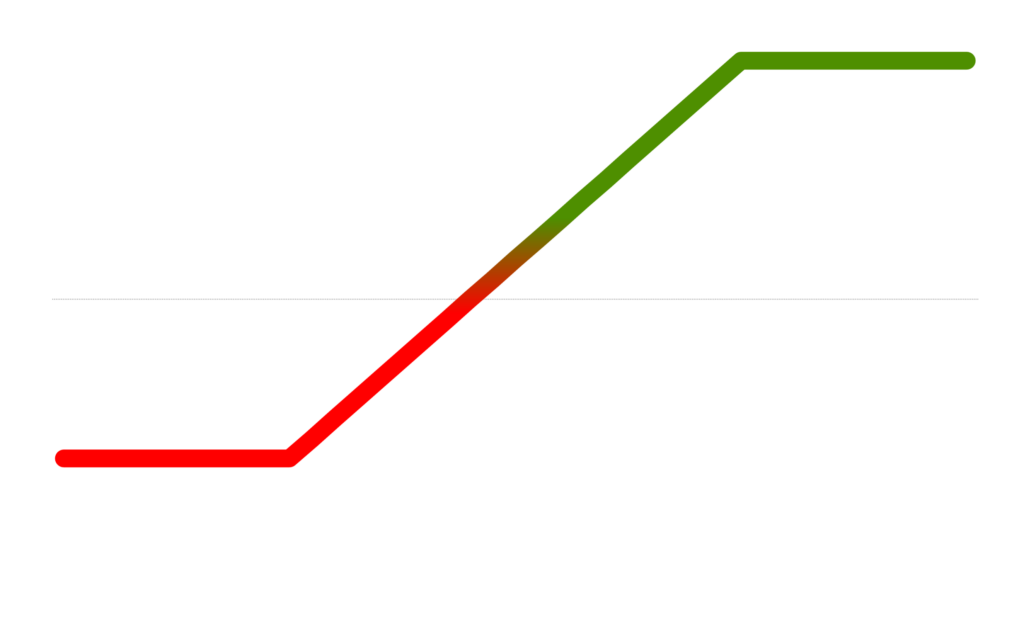

The purpose of the Strike x Price Report is to help traders identify mis-pricing opportunities in the option chain. Option pricing models (like Black Scholes) predict relatively smooth pricing curves relative to the strike.

When using this report traders can select their stock/ETF, expiration date, volatility assumption and range of strikes to review. The report will then provide option prices, volume for the selected range of strikes and compare those prices to the Black Scholes theoretical price.

When a trader notices that a particular strike is priced higher than its Black Scholes price – yet another strike is priced lower than its Black Scholes price – the opportunity to create a debit or credit spread exists. Sell the “expensive” option and buy the “cheap” one.

When a trader notices that a large spike in volume is occurring for an ATM put or call, they might be able to follow along with a squeeze in the underlying price, in gamma or simply participate on the coattails of what might be considered a “whale” trade.

Next Steps

Only members can access this feature but a delayed or alternative version might be available on discord, reddit, twitter or e-mail. Have questions or need support? Join the discord server for the fastest response, or fill out our contact form to report something else.