Put Credit Spreads

Introduction to Put Credit Spreads

Put Credit Spreads are a pivotal strategy in options trading, offering traders a way to potentially profit from stable or rising stock prices. This strategy involves simultaneously selling a put option and buying another put option with a lower strike price. The trader receives a net credit for the trade, representing the maximum potential profit.

Key Takeaways from Put Credit Spreads Article:

- Put Credit Spreads: A strategy involving selling and buying put options with different strike prices.

- Risk Management: Defined risk with a known maximum potential loss.

- Profit Potential: Limited to the net credit received.

- Cost Efficiency: Relatively lower fees compared to some other options strategies.

- Margin Requirement: Based on the maximum potential loss, typically lower than uncovered options trades.

- Strategy Suitability: Best in stable to slightly bullish markets.

- Execution Strategy: Involves careful selection of strike prices, expiration dates, and regular position monitoring.

- Risk Factors: Primary risk is stock price falling significantly below the strike price of the sold put.

- Risk Level of Put Credit Spreads: Considered conservative, but with inherent risks like any options strategy.

- Best Strategy Practices: Includes selecting stable stocks, appropriate strike prices, and managing risks effectively.

- Credit Spread Mechanics: Involves selling a higher-value option and buying a lower-value option, generating a net credit.

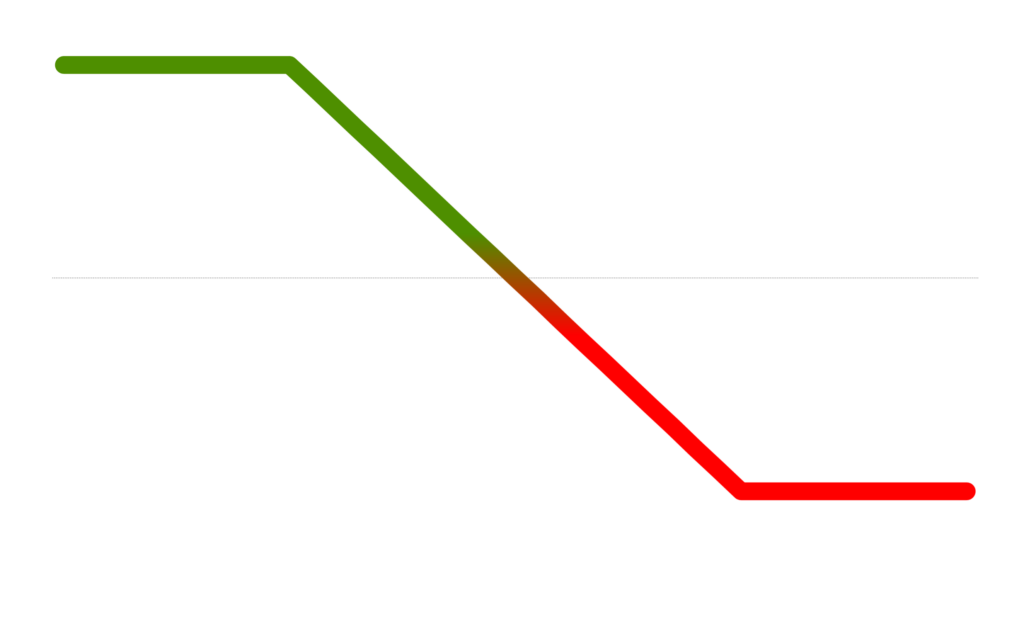

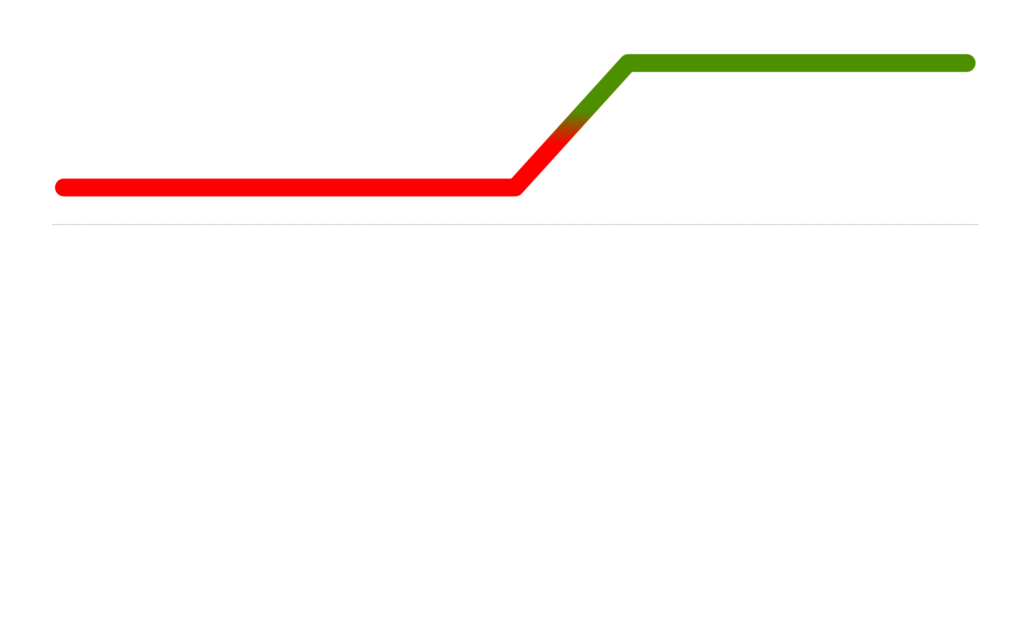

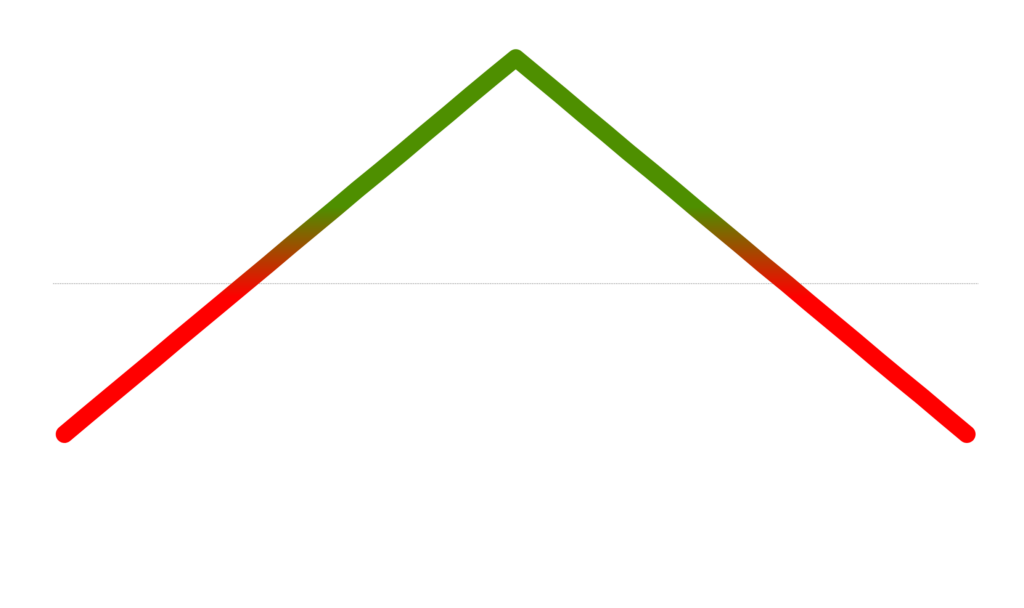

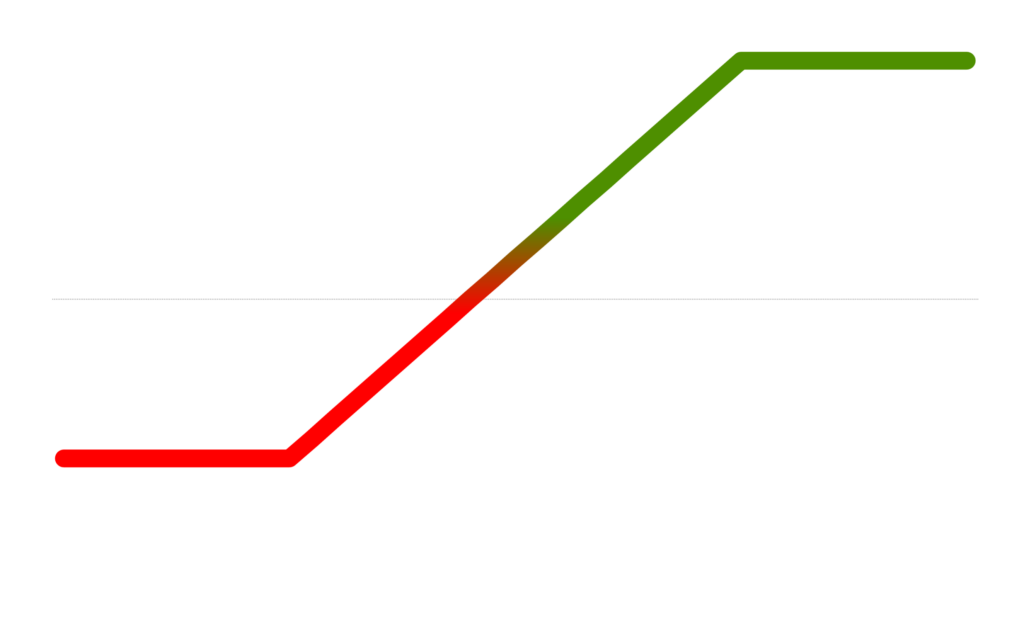

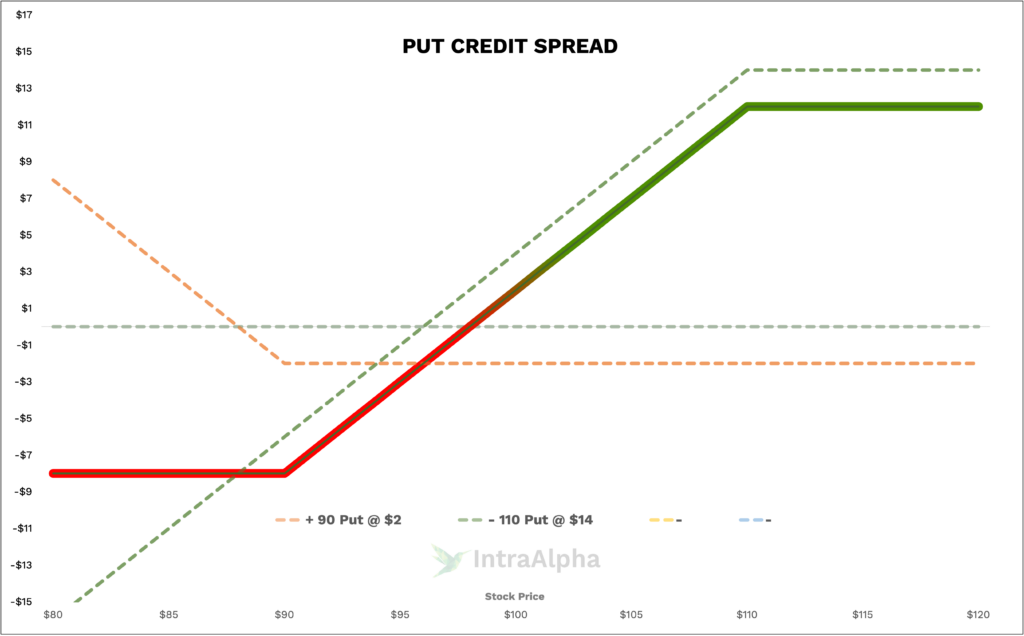

Put Credit Spread Profit and Loss Diagram

Let’s plot a simple Put Credit Spread so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Here are the underlying contracts represented in the graph above.

| – | Option 1 | Option 2 | Option 3 | Option 4 |

|---|---|---|---|---|

| Type | Put | Put | -Select- | -Select- |

| Long/Short | Long | Short | -Select- | -Select- |

| Strike | 90 | 110 | 100 | 100 |

| Premium | 2 | 14 | 5 | 5 |

| Quantity | 1 | 1 | 1 | 1 |

Understanding Put Credit Spreads

Put Credit Spreads are comprised of two put options: one sold (short) and one bought (long), both on the same underlying asset with the same expiration date but different strike prices. The spread narrows as the price of the underlying asset rises, making this strategy ideal for moderately bullish or neutral market outlooks.

Selling Put Credit Spreads Trades

Consider XYZ Corp trading at $100. A trader executes a long Put Credit Spread by selling a put option with a strike price of $95 and buying a put with a strike price of $90, expiring in 45 days. The premium collected totals $150, representing the net credit and maximum potential profit. The maximum loss is the difference in strike prices minus the premium, here being $350. The trader’s goal is for XYZ to stay above $95, allowing both puts to expire worthless, retaining the premium.

Commissions and Fees with Put Credit Spreads

Compared to other options strategies, Put Credit Spreads are relatively cost-efficient. Assuming each leg incurs a $1 fee, the total round-trip trade cost is $2. This cost represents about 1.3% of the total trade value using the XYZ example. These percentages can vary, but Put Credit Spreads often have lower relative fees.

Margin Impact of Put Credit Spreads

Using the XYZ Corp example, the margin requirement is typically the maximum potential loss. In this case $500, the distance between the strikes, must be held in margin. Keep in mind the $150 received in premium is free to be deployed – that is your max gain and the money is in your account ready to be deployed or withdrawn. With this in mind your buying power reduction is actually only reduced by $350 (max loss – premium received). This impacts the available trading capital but is lower than the margin required for uncovered options trades.

Benefits and Risks of Put Credit Spreads

The benefits include defined risk, lower capital requirement, and profit potential in both bullish and bearish markets. However, risks involve limited profit potential and the possibility of the entire premium being lost if the market moves against the position.

Proven Tips for Success with Put Credit Spreads

Successful trading involves careful selection of strike prices and expiration dates, considering market volatility and underlying trends. Regular monitoring and willingness to adjust or close the position are also crucial. Keep in mind, the higher the delta the higher the probability that the underlying stock moves past your sold strike.

Real-Life Put Credit Spread Examples

In the XYZ Corp example, if the stock remains above $95 at expiration, the trader retains the $150 premium. However, if XYZ falls below $90, the maximum loss of $350 is realized.

When and Why Traders Use Put Credit Spreads

Traders use Put Credit Spreads in stable to slightly bullish markets. The aim is for the underlying stock to stay above the strike price of the sold put. They are often used to generate income or hedge against minor price declines in a stock they own. If you are bullish on a particular stock, and that stock has recently sold off or has elevated Implied Volatility it might be a good idea to consider putting on a Put Credit Spread.

Are Put Credit Spreads Risky?

While Put Credit Spreads are generally considered a relatively conservative options strategy, they do carry inherent risks. The primary risk is the potential loss of the entire spread width minus the credit received. This loss occurs if the stock price falls significantly below the strike price of the put option sold. Additionally, market volatility and unexpected economic events can impact the performance of Put Credit Spreads. However, the defined risk nature of this strategy – knowing the maximum potential loss upfront – allows traders to manage and mitigate risk more effectively compared to some other, more aggressive options strategies.

What is the Best Strategy for Put Credit Spreads?

The best strategy for Put Credit Spreads involves careful market analysis and prudent selection of strike prices and expiration dates. Key factors include:

- Choosing the Right Stock: Select a stock with stable price action, preferably one in a slight uptrend or with bullish sentiment.

- Strike Price Selection: Opt for a strike price for the sold put that is below the current market price, ideally where you believe the stock will not fall below.

- Expiration Date: Shorter expiration periods can be beneficial as they reduce the risk of the stock moving significantly against the position.

- Managing Risk: Set clear rules for when to exit or adjust the trade, such as a specific percentage of the max loss or a particular stock price level.

- Monitoring Market Conditions: Stay updated with market trends and adjust your strategy accordingly. Volatility indicators can be particularly useful.

How Does a Credit Spread Work?

A credit spread is an options trading strategy where a trader simultaneously buys and sells options of the same class (puts or calls), same underlying security, and same expiration date, but at different strike prices. The option sold is more expensive than the option bought, which creates a net credit to the trader’s account.

Here’s a simplified breakdown:

- Selling an Option: The trader sells an option, which generates a premium (income). This option is typically closer to the current market price and has higher value.

- Buying an Option: Simultaneously, the trader buys an option with a lower premium, further out of the money. This option acts as a hedge, limiting the maximum potential loss.

- Net Credit: The difference in premiums between the sold and bought options results in a net credit. This is the maximum profit the trader can achieve in the trade.

- Outcome at Expiration: If the stock price stays above the two strike prices or moves in the predicted direction by expiration, the trader can retain the full credit. If the market moves unfavorably, the trader faces a loss, limited to the difference between the strike prices minus the net credit received.

The credit spread strategy is favored for its ability to define both the maximum profit and loss upfront, offering a structured approach to options trading.

Conclusion

Understanding and mastering Put Credit Spreads is essential for options traders looking to diversify their strategies. This approach offers a balance of risk and reward, suitable for various market conditions. For further assistance in trading, don’t hesitate to message us on X.com or Discord for more support.