Covered Short Straddle

Introduction to the Covered Short Straddle

Options trading offers a myriad of strategies to investors, each with its unique characteristics and risk-reward profiles. One such strategy that has gained prominence among traders is the Covered Short Straddle. In this article, we will delve into the intricacies of this strategy, its application, benefits, and potential risks. Also known as the “Covered Straddle,” this approach combines the concepts of selling covered calls and puts to create a versatile trading strategy.

Key Takeaways

- Covered Short Straddle is an options trading strategy involving the simultaneous sale of call and put options on the same underlying asset.

- This strategy generates income through the premiums collected and is suited for neutral market conditions.

- The risk associated with Covered Short Straddles includes potential assignement at expiration.

- Traders use this strategy when they expect minimal price movement in the underlying asset and aim to profit from options premiums.

- Proper risk management and careful selection of underlying assets are essential for success with Covered Short Straddles.

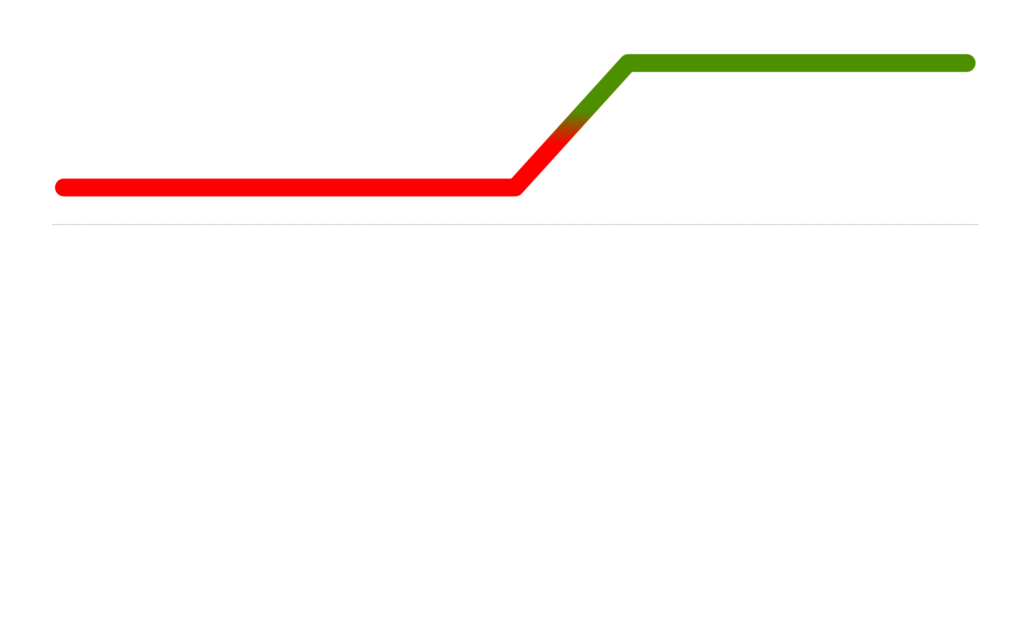

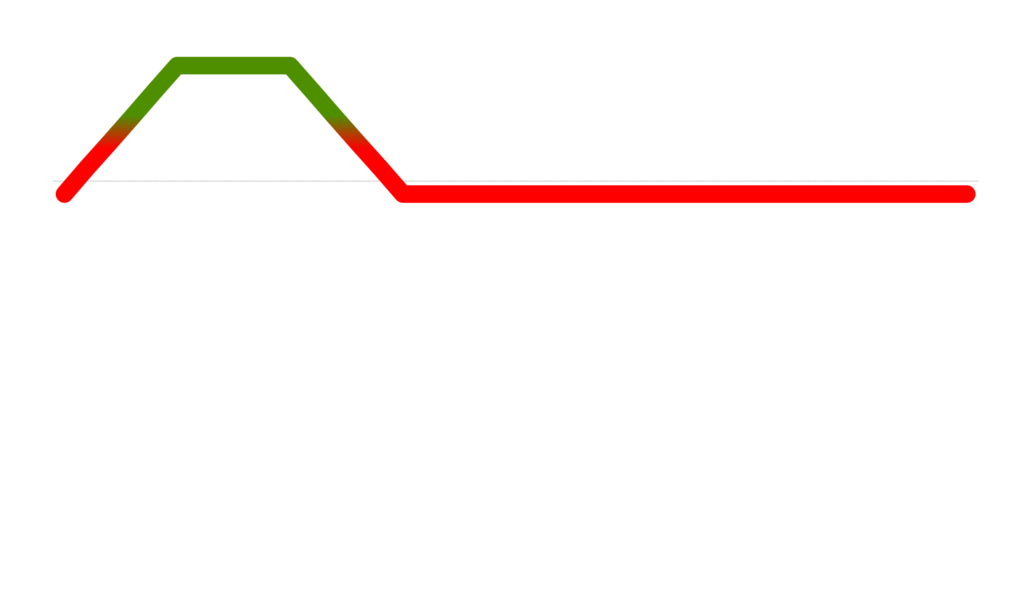

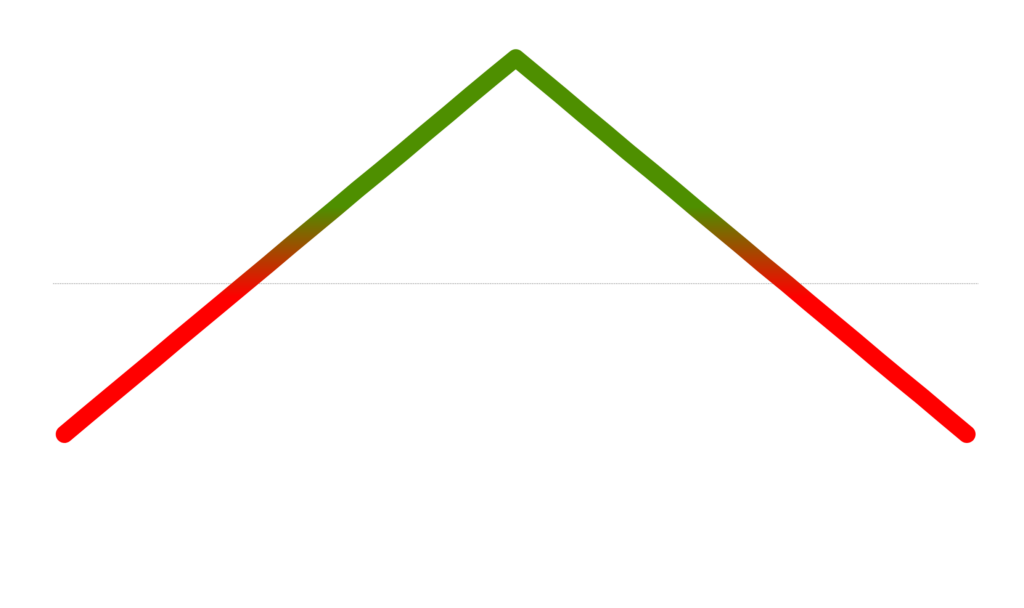

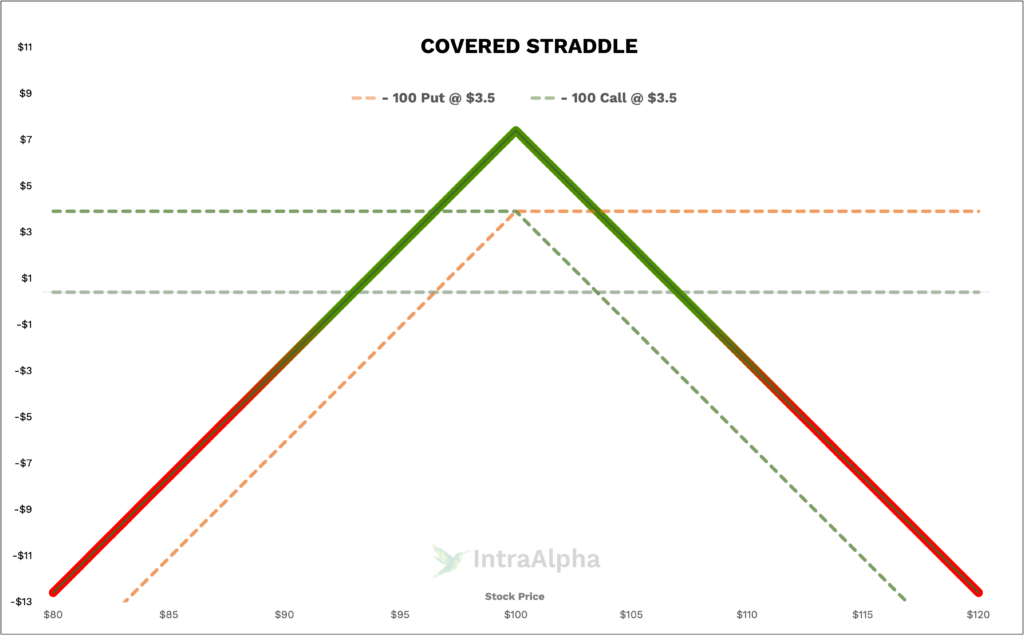

Covered Straddle Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Covered Short Straddles

Before we delve into the nuances of the Covered Short Straddle, it’s essential to grasp the core concepts of this option strategy. This strategy involves simultaneously selling both a call and a put option on the same underlying asset, with the same strike price and expiration date. The term “covered” signifies that the trader holds a position in the underlying asset (e.g., stock), covering the potential obligations of the call option.

Long Covered Straddle Trades

To illustrate the mechanics of a Covered Short Straddle, let’s consider a practical example using XYZ Corporation, which is currently trading at $100 per share. Suppose a trader decides to execute this strategy with XYZ stock. They would sell a call option with a strike price of $100 and simultaneously sell a put option with the same $100 strike price, both expiring in 45 days.

The premium collected from selling these options would vary but it could be $350 per contract. Let’s assume the total premium collected for both the call and put options is $700. This premium is the amount the trader receives upfront as compensation for taking on the obligations of the options.

It’s crucial to note that this premium serves as a buffer against potential losses in the trade. If the stock price remains around $100 at expiration, both the call and put options will expire worthless, and the trader retains the entire premium as profit.

Commissions and Fees with Covered Short Straddles

When evaluating the cost and fees associated with trading a Covered Short Straddle, it’s essential to consider the relative expenses compared to other option trading strategies. Assuming a commission of $1 per leg (buying and selling the call and put options), a round trip trade would incur $4 in fees.

In percentage terms, the cost of these fees is relatively low compared to the potential premium collected in the trade. The $4 in fees represents only a fraction of the $700 premium received upfront. Therefore, the cost of trading fees in this strategy is modest compared to the overall value of the trade.

Margin Impact of Covered Short Straddles

The margin impact of executing a Covered Short Straddle varies depending on the underlying asset’s price and volatility. Using our previous example of XYZ Corporation trading at $100, executing this strategy would require margin coverage for the sold put option. The call side would be covered by the ownership of the 100 shares.

The margin requirement typically reflects the potential loss that could occur if the stock price moves significantly. As the Covered Short Straddle involves both selling a call and a put option, the margin impact can be substantial, and traders should be prepared to allocate the necessary margin.

Benefits and Risks of Covered Short Straddles

Like any trading strategy, the Covered Short Straddle comes with its set of advantages and risks. Let’s explore both aspects:

Advantages:

- Income Generation: By selling both call and put options, traders can generate immediate income in the form of premiums.

- Limited Risk: The premium received serves as a buffer against potential losses, limiting the downside risk.

- Neutral Outlook: This strategy thrives in neutral market conditions, making it suitable when the trader anticipates little to no significant price movement in the underlying asset.

Risks:

- Unlimited Losses: In extreme market movements, losses can potentially be significant, as there is no cap on potential losses.

- Margin Requirements: The margin required for this strategy can tie up a substantial amount of capital.

- Price Swings: If the underlying asset experiences substantial price swings, the trader may face challenges managing the position.

Proven Tips for Success with Covered Short Straddles

To succeed in trading Covered Short Straddles, consider the following tips:

- Monitor the Position: Keep a close eye on the underlying asset’s price and adjust the position if necessary to manage risk.

- Select the Right Underlying Asset: Choose assets with relatively low volatility and stable price movements.

- Risk Management: Use stop-loss orders or other risk management tools to limit potential losses.

Real-Life Covered Short Straddle Examples

Let’s revisit our XYZ Corporation example to see how a Covered Short Straddle might play out in real-life scenarios:

Scenario 1 – Neutral Market: If XYZ Corporation’s stock price remains around $100 at expiration, the trader will close both the call and put options for a minimal amount. Therefore, the trader retains almost the $700 premium collected as profit.

Scenario 2 – Slight Price Movement: Suppose the stock price moves slightly to $105 at expiration. The call option will be exercised, resulting in the assignement of the 100 shares at the strike price of $100. The put option will expire worhtless.

Scenario 3 – Significant Price Swing: In the event of a substantial price swing, such as the stock plummeting to $90 at expiration, the put option would be exercised. The trader would face a loss of $1000, which is mitigated by the $700 premium collected, resulting in a net loss of $300. Before expiration, in order to avoid assignement, the trader can choose to close the trade.

When and Why Traders Use Covered Short Straddles

Traders often employ the Covered Short Straddle strategy in specific market conditions and with particular expectations:

Market Conditions:

- Neutral Outlook: This strategy is ideal when traders expect minimal price movement in the underlying asset.

- Low Volatility: It thrives in low-volatility environments where the options’ premiums are relatively high.

Objectives:

- Income Generation: Traders use this strategy to generate income from the premiums collected.

- Risk Management: It can serve as a risk management tool in neutral markets, where losses are limited.

How do Covered Short Straddles Work?

The mechanics of a Covered Short Straddle involve selling both a call and a put option with the same strike price and expiration date. The trader collects premiums from both options, which act as a cushion against potential losses. If the stock price remains near the strike price at expiration, the options expire worthless, and the trader retains the premium as profit.

Are Covered Short Straddles Risky?

Covered Short Straddles come with risks, particularly in volatile markets. The potential for unlimited losses in extreme price movements makes this strategy risky. However, when employed in neutral market conditions, with proper risk management, these risks can be mitigated.

Are Covered Short Straddles Bearish or Bullish?

Covered Short Straddles are a neutral strategy. They do not rely on the market’s direction but rather on the stability of the underlying asset’s price. This strategy profits from limited price movement, making it neither distinctly bearish nor bullish.

Conclusion

In conclusion, the Covered Short Straddle is a versatile options trading strategy that allows traders to generate income in neutral market conditions. It combines the sale of both call and put options with the same strike price and expiration date, providing a buffer against potential losses. While it comes with risks, including the potential for unlimited losses in extreme market movements, it can be a valuable addition to a trader’s toolkit when used judiciously.

To master the Covered Short Straddle and other option trading strategies, continuous learning and practice are essential. If you need assistance or have further questions about trading strategies, feel free to message us on X.com or Discord for more support.