How to Use the Volatility x Expiration Chart

The purpose of the Volatility x Expiration Report is to locate option pricing opportunities over time. Rather than looking at strikes, or individual contract prices, we are instead looking at a blended average of Implied Volatility plotted against the upcoming expiration cycles.

When using the report traders can select their underlying stock/ETF and the number of expiration cycles to review. The report will then return the volume and volatility for a blended basket of calls and puts.

The purpose of the Volatility x Expiration Report is to locate option pricing opportunities over time. Rather than looking at strikes, or individual contract prices, we are instead looking at a blended average of Implied Volatility plotted against the upcoming expiration cycles.

Finding Mispricing:

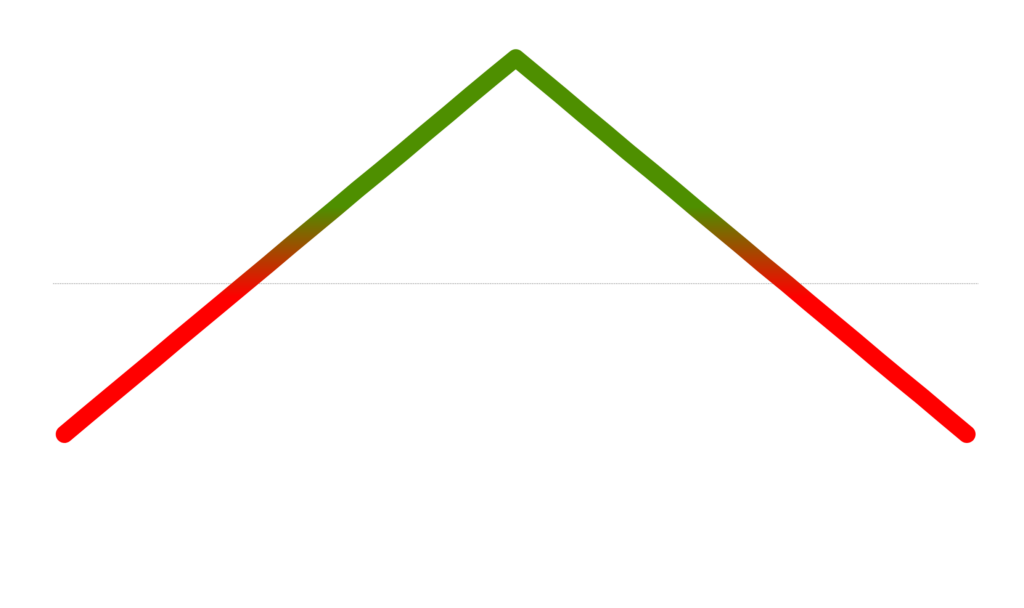

We would expect to see a smooth curve of decreasing volatility into the future, but often times we see spikes in volatility relative to earnings events or put/call skew which distort the pricing.

Finding Extreme Skew:

The report can also help visualize put call skew as it pertains to volatility – because higher than average relative volatility for a particular expiration cycle might mean traders are “buying up calls before earnings” or “buying puts ahead of the big news event.”

Finding Liquidity:

See where the most volume is being traded so you can pick an expiration cycle that has the presumed best bid/ask spread.

Calendar Spreads:

Use the expiration cycle graph to easily determine how much you are getting paid in volatility by buying or selling a calendar spread across various expiration cycles.

Avoiding Event Based Trading Errors:

Want to avoid earnings? The report will show you the upcoming earnings dates and where potential event driven volatility events are lurking.

In Conclusion:

In short, option pricing models (like Black Scholes) produce relatively smooth and predictable curves relative to time. When a trader notices a distorted, inverted or bumpy curve when comparing Implied Volatility to Time – then a potential trading opportunity exists.

Next Steps

Only members can access this feature but a delayed or alternative version might be available on discord, reddit, twitter or e-mail. Have questions or need support? Join the discord server for the fastest response, or fill out our contact form to report something else.