How to Use the Option Screener

What is the Options Screener?

The Options Screener is a customizable tool designed to help you identify profitable trade setups. It employs an expanding set of criteria to refine and narrow down the options available in the market. By selecting specific criteria that align with your trading strategy and goals, you can generate reports that highlight options that meet your requirements.

The tool allows you to customize various parameters such as percent away from the at-the-money strike, efficiency percent, market cap minimum, stock price minimum, directional filter, and weeks until expiration. By adjusting these criteria, you can focus on options that align with your preferred risk-reward profile and market conditions.

Once you have chosen your desired criteria, the Options Screener generates detailed reports that present the options that meet your specified parameters. These reports can be shared with others on platforms like Reddit and Twitter, enabling you to discuss and exchange trading ideas with the community.

Whether you are an experienced trader or just starting out, the Options Screener provides you with a powerful tool to explore and identify potentially profitable trade setups based on your customized criteria.

Screener Criteria:

Once you have selected from the following criteria, the Options Screener will generate a comprehensive series of reports. These reports serve as a valuable resource to assist you in your trading decisions by providing detailed information and analysis based on your chosen criteria.

- Percent Away: Analyze options [x] percentage away from the at-the-money strike. For an underlying stock which trades at $100, a value of 3% would look for call options around the 103 strike and put options around the 97 strike.

- Efficiency Percent: Return options that are at least [x] percent efficient when considering the bid/ask spread and the underlying option price. An option that has a bid of $0.97 and an ask of $1.03 would have a $0.06 spread relative to a mid price of $1.00. This option would have a 94% efficiency value.

- Market Cap Minimum: Only return options with underlying stocks whose market cap exceeds this value in billions.

- Stock Price Minimum: Only return options with underlying stocks whose last close price exceeds this value.

- Directional Filter: Only return options with underlying stocks that are within + or – this [x] value of the directional value we compute. (Read more on direction). If a value of 10 is used, stocks with a directional value of +10 or greater and -10 or less will be excluded from the results.

- Weeks Until Expiration: Analyze options that are expiring as close as possible to [x] weeks away from today’s date.

Screener Columns Explained:

For each generated report, there are multiple columns that provide valuable information and insights. You have the flexibility to select or hide specific columns based on your preferences and the specific details you find most relevant. While the choice of columns may vary depending on individual trading strategies and goals, here are some important columns that are commonly considered:

- HV: This stands for Historical Volatility and looks at the logarithmic mean of daily returns on an annualized basis. In other words, how volatile has this underlying stock been in the past? This is in contrast to Implied Volatility which represents the prices option traders are willing to pay for the expected volatility in the future.

- Call Premium and Put Premium: The word “premium” represents the relationship between HV and IV. If a stock has an HV of 20 but an IV of 30, then its options carry a 1.5x premium on the implied forward-looking volatility relative to realized historical volatility.

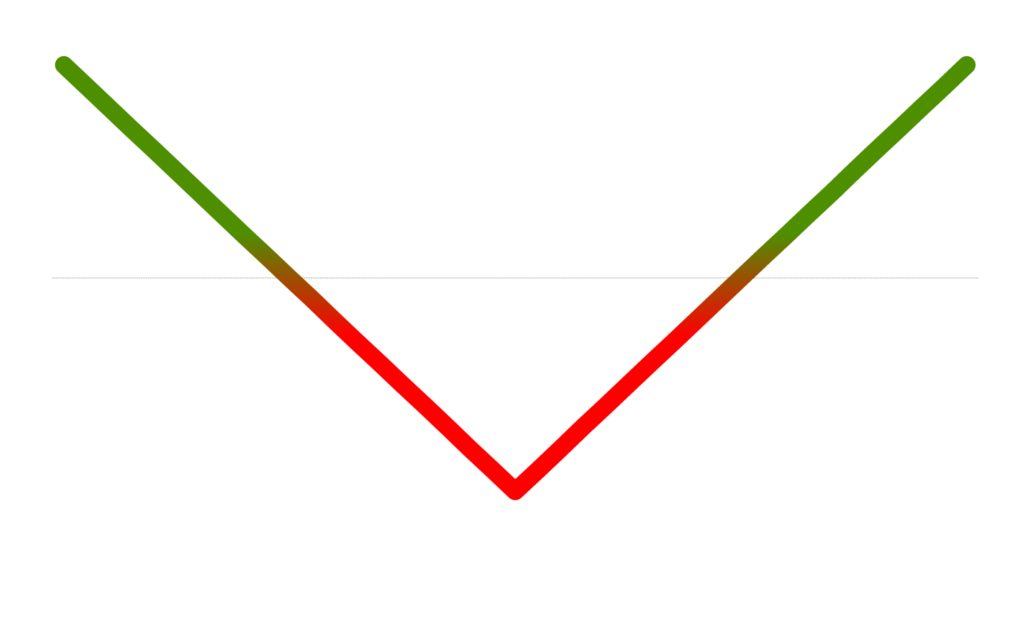

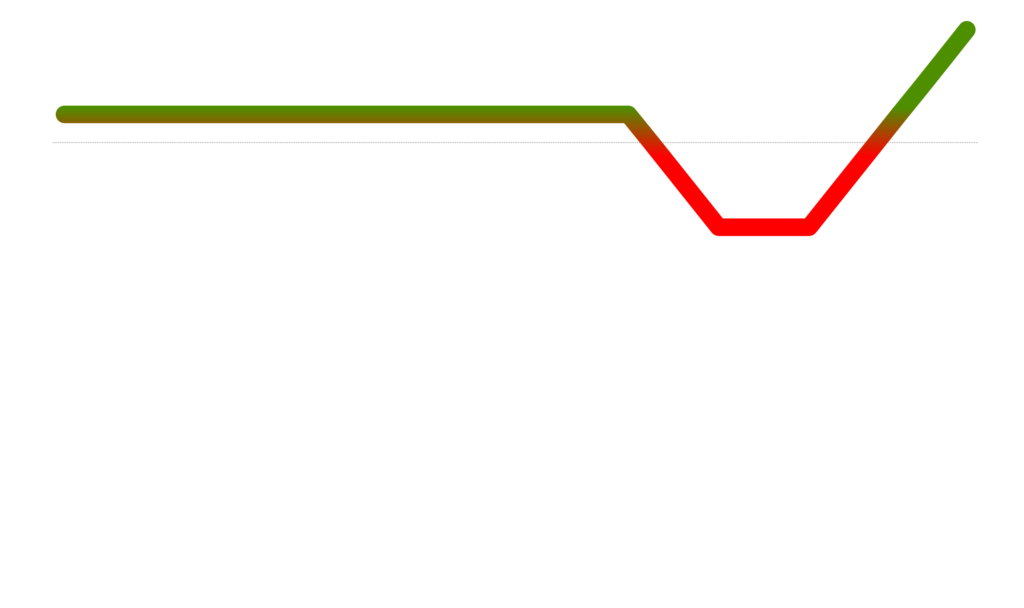

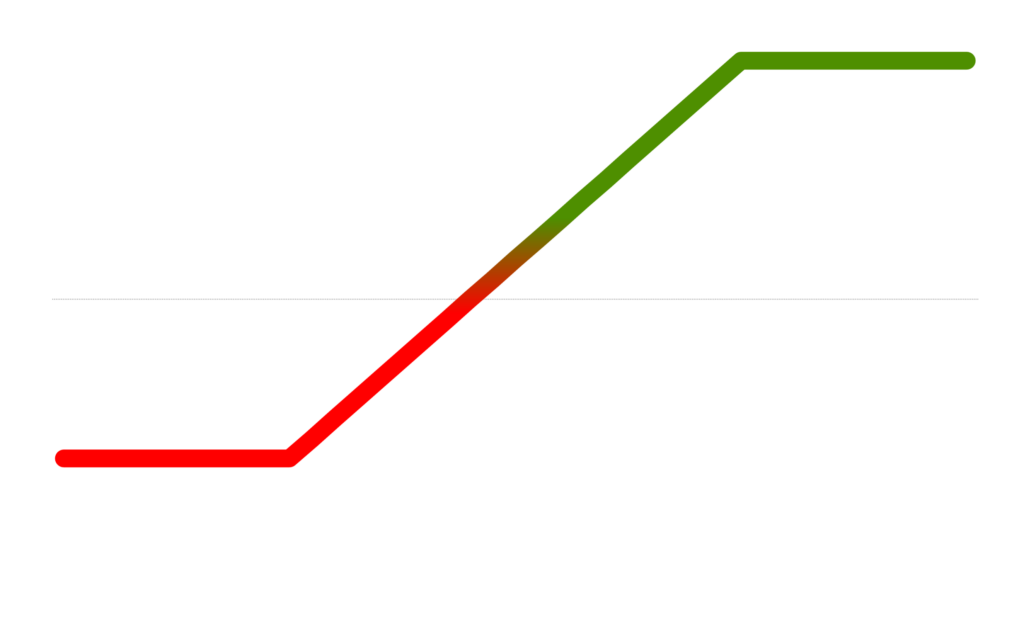

- Direction: Ranges from -100 (bearish) to +100 (bullish) and accounts for RSI, price trend, moving averages, and put/call skew. A growing number of technical indicators are weighted and averaged to produce one figure to represent the bullish or bearish trend of the stock during the time period.

- E.R.: This represents the number of days until the next Earnings Release (E.R.). Use this value to find upcoming earnings trades, or to avoid them.

- Priced(+) and Priced(-): This represents the dollar change necessary in the underlying stock to break even by the expiration date.

- Stock/C/P: This column combines the underlying stock, call strike, and put strike that were used in the analysis represented in the table.

- Beta: Beta is the sensitivity of the underlying stock to the movements of SPY. A value of 2.3 means that the underlying tends to move (up or down) 2.3 times the magnitude that SPY moved on that same day. This is another measure of volatility.

Screener Results and How to Trade Them:

After generating customized reports using the Options Screener, it is important to understand how to interpret and utilize the results effectively for trading purposes. This section focuses on strategies for interpreting and leveraging the screener results, equipping you with the necessary tools to navigate the complexities of the options market with precision.

- Cheap Calls: These call options offer the lowest ratio of implied volatility (IV) relative to historical volatility (HV). These options are priced expecting the underlying to move up less than it has moved up in the past. Buy these calls.

- Expensive Calls: These call options offer the highest ratio of call implied volatility (IV) relative to historical volatility (HV). These options are priced expecting the underlying to move up significantly more than it has moved up in the past. Sell these calls.

- Cheap Puts: These put options offer the lowest ratio of put implied volatility (IV) relative to historical volatility (HV). These options are priced expecting the underlying to move down less than it has moved down in the past. Buy these puts.

- Expensive Puts: These put options offer the highest ratio of bearish premium paid (IV) relative to historical volatility (HV). These options are priced expecting the underlying to move down significantly more than it has moved down in the past. Sell these puts.

- Most Bearish: These stocks and put options are the most directionaly bearish. Fade the recent bearish action by selling high premium puts or join the trend with puts with low “Put Pricing.”

- Most Bullish: These stocks and call options are the most directionally bullish. Fade the recent bullish action by selling high premium calls or join the trend with calls with low “Call Pricing.”

- Highest Premium: These options offer the highest ratio of implied volatility (IV) relative to historical volatility (HV). These options are priced to move more than they have moved in the past. Sell iron condors on these as they may be over priced.

- Upcoming Earnings: These stocks have earnings approaching and their premiums are usually elevated as a result. These are high risk high reward option plays where you can buy (long options) or sell (short options) the expected move.

- Most Efficient: These stocks have the best liquidity. This means that they offer the least slippage, tightest spreads and the cheapest cost of a round trip trade. Best for short term trades.

Examples:

In this section, we provide illustrative examples of trades based on the results generated by the Options Screener. These examples aim to demonstrate how the screener results can be translated into actionable trade ideas. By examining these examples, you can gain practical insights into how the screener results can be applied to real trading situations. (Please note that these trades, and all screener results, are for helping you generate trading ideas and should not be considered as financial advice.)

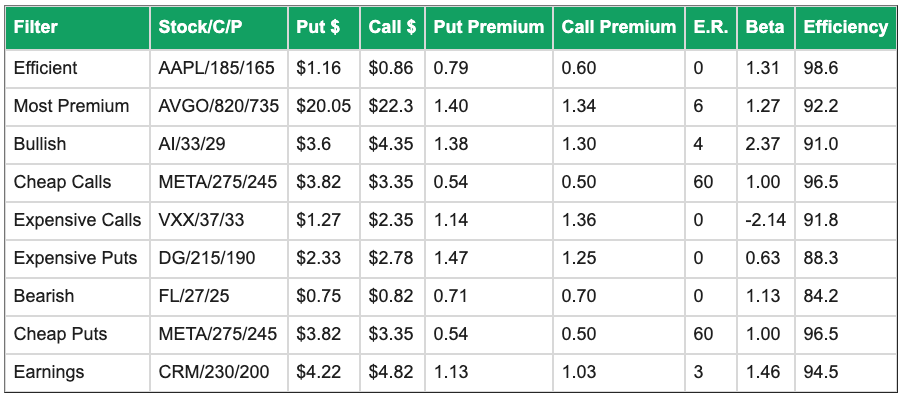

Assuming a bearish outlook and two of the tables:

- From the “Expensive Calls” table, sell a [call credit spread, strangle, calendar spread] on the underlying stock. The premise is that the stock is priced to move up more than it has in the past.

- From the “Cheap Puts” table, consider buying [puts, put debit spreads] that are selling below the value of 1 in the “Put Premium” column because the premise is that the options are under priced relative to the volatility in the past (HV).

In this result below, you might consider buying the 245 META put because it is the most “underpriced” option in the table.

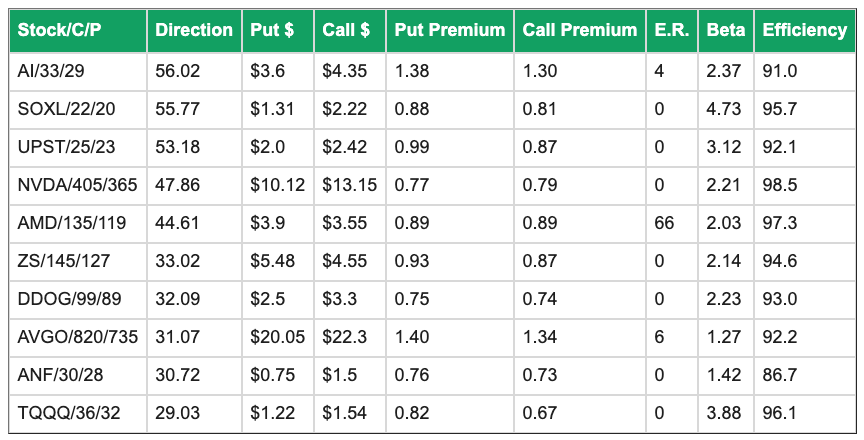

Assuming a option premium / selling strategy (thetagang):

- From the “Highest Premium” table sell options with the highest premiums on when comparing HV to IV.

- From the “Upcoming Earnings” table sell option spreads after reviewing the expected move priced in the options market and select those options to sell which come with the highest premiums and lowest probability of going in the money at expiration.

In this result below, you might consider selling a 33/29 Iron Condor on AI because the puts and calls are both “overpriced.” However, note that earnings will be released in 4 days which might explain the premiums.

When making trades, you can adjust the strike price further (or closer) to the money and increase (or decrease) the width of your spreads according to your buying power and risk tolerance.

Next Steps

Only members can access this feature but a delayed or alternative version might be available on discord, reddit, twitter or e-mail. Have questions or need support? Join the discord server for the fastest response, or fill out our contact form to report something else.