Option Straddle

Introduction to the Option Straddle

Option Straddle is a unique strategy in options trading that capitalizes on the volatility of the underlying asset rather than its directional movement. This approach, also known as a ‘Straddle trade’, involves holding a position in both a call and a put option with the same strike price and expiration date. It is a popular strategy among traders who expect significant price movement but are unsure of the direction.

Key Takeaways

- Option Straddles are used in volatile markets regardless of direction.

- The strategy involves buying both a call and a put option with the same strike price and expiration.

- Maximum loss is the total premium paid, while profit potential is substantial.

- Effective in periods of market uncertainty or ahead of major announcements.

- Requires careful risk management and market analysis.

- Neither bearish nor bullish, but profits when the asset moves by a large amount either way.

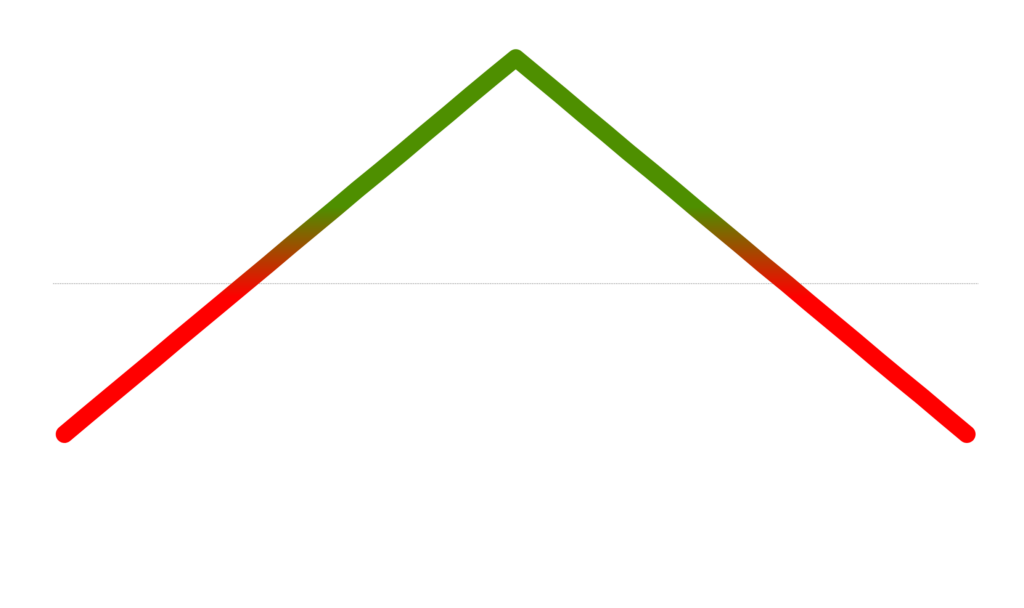

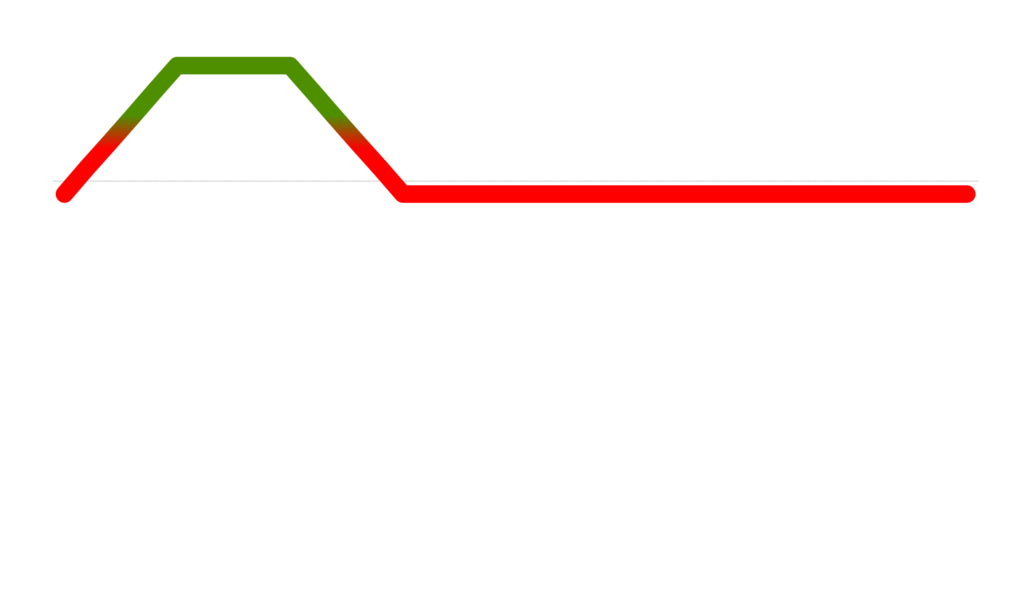

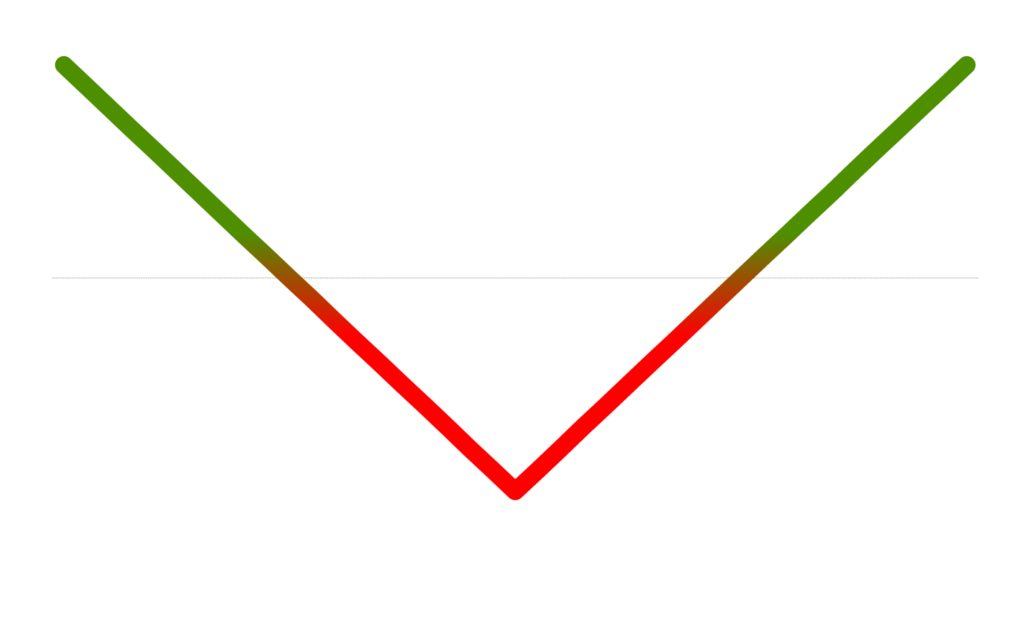

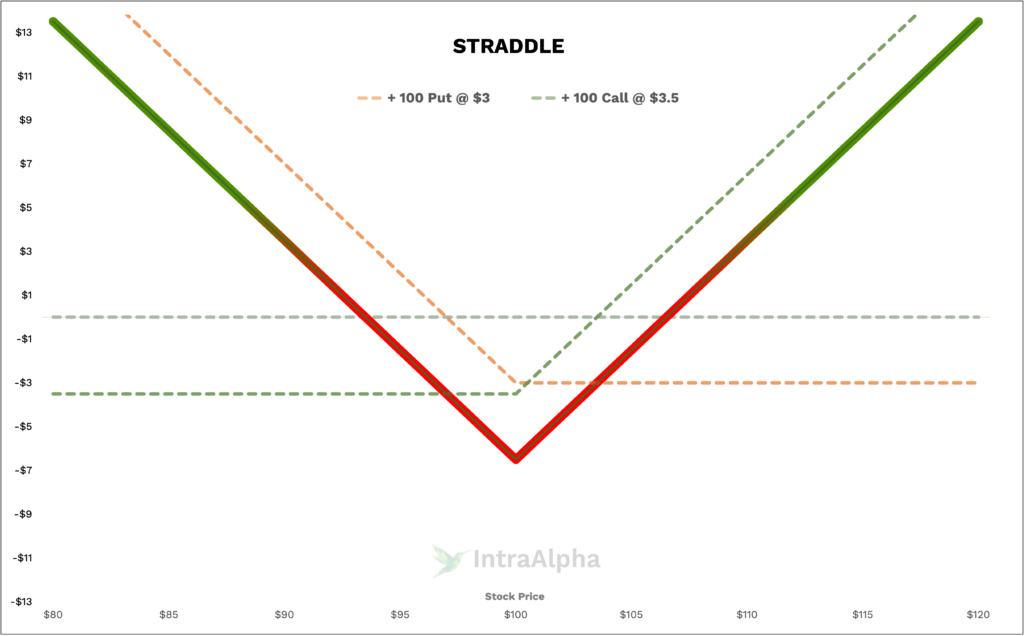

Option Straddle Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Option Straddles

At its core, an Option Straddle consists of buying or selling a call and a put option on the same underlying security, with identical strike prices and expiration dates. The strategy is designed to profit from significant price movements in either direction. If the price of the underlying asset moves significantly, either the call or the put option can be profitable enough to cover the loss of the other option and still yield a net gain.

Long Option Straddle Trades

In a Long Option Straddle, a trader buys both call and put options. For example, with XYZ Corp trading at $100, a trader might buy a 45-day call and a 45-day put, both at a $100 strike price. Suppose the premium for the call is $350 and for the put is $300, making the total premium spent $650. This represents the maximum loss if XYZ stays at $100 at expiration. The profit potential, however, is unlimited on the upside and substantial on the downside, limited only by the stock reaching zero.

Commissions and Fees with Option Straddles

Option Straddle trades involve multiple transactions, thus incurring higher commissions and fees compared to single-option trades. Assuming a fee of $1 per leg, a round-trip trade (entry and exit) for a straddle would cost $4 in fees. If the total trade value is $650, as in the XYZ example, fees represent about 0.6% of the trade value, relatively higher than single-leg trades.

Margin Impact of Option Straddle

Using the XYZ Corp example, if the trader’s account is margin-approved, the margin requirement will typically be the cost of the long straddle (in this case, $650). This amount is set aside by the broker as collateral for the position. It’s important to remember that using margin increases potential returns but also amplifies risks.

Benefits and Risks of Option Straddle

The main advantage of an Option Straddle is its ability to profit from volatility irrespective of the market’s direction. However, the risks include the loss of the entire premium paid if the underlying asset fails to move significantly. The strategy requires a careful balance of risk management and market analysis.

Proven Tips for Success with Option Straddle

Successful Option Straddle trading involves monitoring market volatility, understanding underlying assets, and precise timing. It’s crucial to be aware of upcoming events that could trigger price movements and to have a clear exit strategy to mitigate losses.

Real-Life Option Straddle Examples

In the XYZ Corp scenario, if the stock moves significantly above $100, the value of the call option increases while the put option loses value, and vice versa if the stock falls sharply. The goal is for one of the options to gain more than the combined premiums paid.

When and Why Traders Use Option Straddles

Traders often turn to Option Straddles in periods of uncertainty or ahead of major announcements. The strategy is used when a significant movement is expected, but the direction of the move is unclear. Traders use straddles hoping that the movement in the underlying asset will be enough to outweigh the cost of the premiums.

How do Option Straddle Work?

The mechanics involve buying a call and a put option with the same strike price and expiration. The profitability hinges on the underlying asset’s price moving enough to cover the cost of both premiums.

Are Option Straddle Risky?

While Option Straddles offer unlimited upside potential, they also carry the risk of losing the entire premium paid if the underlying asset does not move enough. This strategy requires a careful evaluation of risk tolerance.

Are Option Straddle Bearish or Bullish?

Option Straddles are neither inherently bearish nor bullish. They are neutral strategies that profit from volatility in either direction.

Conclusion

Mastering the Option Straddle is crucial for traders seeking to benefit from market volatility without having to predict the direction of movement. Remember, if you need further assistance in trading Option Straddles, feel free to message us on X.com or Discord for more support.