Short Straddle

Introduction to the Short Straddle

The Short Straddle, also known as a “Short Combination,” is a versatile options trading strategy that can play a pivotal role in an investor’s arsenal. This strategy involves selling both a call and a put option with the same strike price and expiration date. It’s a neutral strategy, making it ideal for traders who anticipate limited price movement in the underlying asset.

Key Takeaways

- The Short Straddle strategy involves selling both a call and a put option with the same strike price and expiration date.

- Short Straddles are neutral strategies that profit from minimal price movement in the underlying asset.

- Traders use Short Straddles to generate income but should be aware of the unlimited loss potential and high margin requirements.

- This strategy is most effective in low-volatility markets and is neither inherently bullish nor bearish.

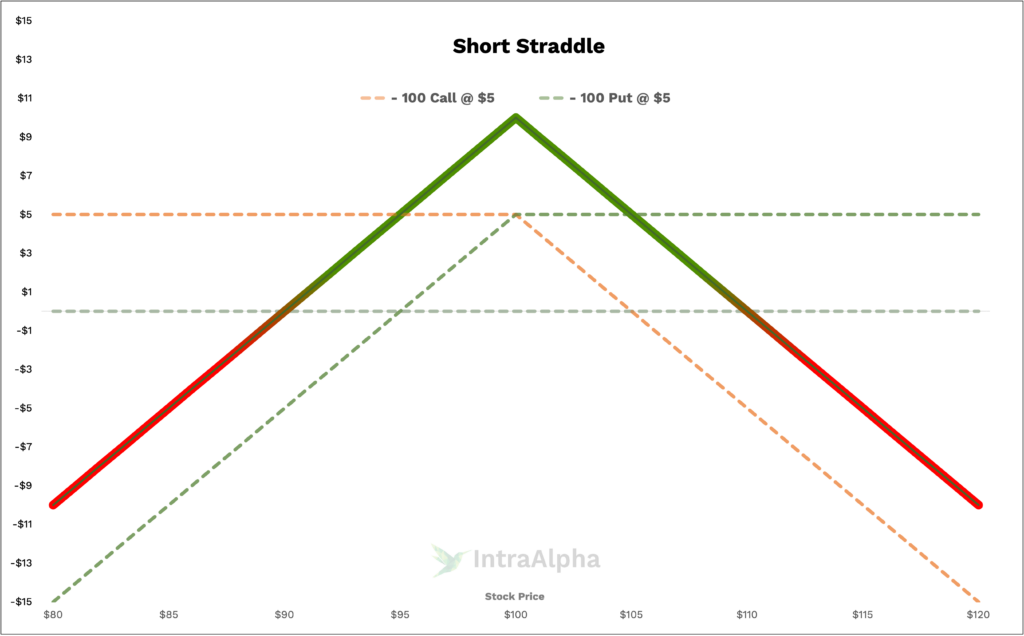

Short Straddle Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Short Straddles

To comprehend the Short Straddle fully, it’s essential to grasp the fundamental concepts of options trading. In the context of this strategy, there are two key elements to consider: calls and puts.

A call option grants the holder the right, but not the obligation, to buy the underlying asset at a specified strike price before the expiration date. Conversely, a put option gives the holder the right, but not the obligation, to sell the underlying asset at a predetermined strike price before the expiration date.

A Short Straddle strategy combines both of these components by selling a call and a put option simultaneously. The strike price and expiration date are identical for both options, making it a non-directional strategy.

Short Straddle Trades

Let’s delve into the specifics of executing a Short Straddle trade with a practical example. Consider XYZ Corporation, currently trading at $100, with an option expiring in 45 days.

For this trade, you would sell one XYZ Corporation call option with a strike price of $100 and simultaneously sell one XYZ Corporation put option with the same $100 strike price and 45-day expiration.

The premium collected for each option can vary, but let’s assume it amounts to $500 each. Therefore, the total premium collected for this Short Straddle trade would be $1000 ($500 from the call and $500 from the put).

Commissions and Fees with Short Straddles

When it comes to trading options, understanding the associated costs and fees is crucial. Compared to some other options strategies, Short Straddles can be relatively inexpensive in terms of commissions and fees.

Let’s assume a round-trip trade, where you both open and close the position, with each leg incurring $1 in fees. In our XYZ Corporation example, this would result in $4 in fees for the entire trade.

To put this in perspective, if the total premium collected for the Short Straddle trade was $1000, the $4 in fees would represent 0.4% of the total premium.

Margin Impact of Short Straddles

The margin impact of a Short Straddle can vary based on the broker’s requirements and the specific circumstances of the trade. However, it’s essential to understand how it could affect your available margin.

Using the XYZ Corporation example with a $100 stock price, you would typically need to maintain margin for both the short call and the short put positions. This margin requirement can tie up a substantial portion of your trading capital, limiting your ability to execute other trades.

Benefits and Risks of Short Straddles

Short Straddles come with their own set of advantages and risks. Let’s take a closer look at these factors:

Advantages:

- Income Generation: Short Straddles allow traders to generate income through the premiums collected from selling both call and put options.

- Non-Directional: This strategy profits from minimal price movement, making it suitable for neutral market conditions.

- Time Decay: As options approach their expiration date, their time value erodes, potentially increasing the profitability of the Short Straddle.

Risks:

- Unlimited Risk: Unlike many other strategies, Short Straddles have unlimited risk on both the upside and downside. If the underlying asset makes a significant move, losses can escalate rapidly.

- High Margin Requirement: The margin requirement for a Short Straddle can be substantial, tying up capital that could be used for other investments.

- Limited Profit Potential: The potential profit is capped at the total premium collected when initiating the trade.

Proven Tips for Success with Short Straddles

To succeed in Short Straddle trading, consider the following practical tips:

- Monitor Closely: Keep a close eye on the underlying asset’s price and be prepared to adjust or close the position if it starts moving significantly.

- Set Stop-Losses: Implement stop-loss orders to limit potential losses if the market makes a sudden and unfavorable move.

- Diversify: Don’t put all your capital into a single Short Straddle trade; diversify your options trading strategies to manage risk.

- Select the Right Underlying Asset: Choose assets with lower volatility when implementing Short Straddles to reduce the risk of extreme price swings.

Real-Life Short Straddle Examples

To better understand how Short Straddles work in practice, let’s consider a few real-world scenarios using our XYZ Corporation example:

- Scenario 1 – Neutral Market: If the stock price remains around $100 throughout the 45-day period, the Short Straddle trader profits from the time decay of both the call and put options, collecting the full premium.

- Scenario 2 – Slight Price Movement: Even if the stock price moves slightly, as long as it stays close to $100, the Short Straddle can still generate profits, albeit reduced compared to Scenario 1.

- Scenario 3 – Significant Price Swing: In the event of a substantial price swing, either upwards or downwards, the Short Straddle trader may incur losses that exceed the premium collected.

When and Why Traders Use Short Straddles

Short Straddles are strategically employed by traders in specific market conditions and with particular objectives in mind. Here’s when and why traders opt for this strategy:

- Low Volatility: Short Straddles are most effective in low-volatility markets, where traders anticipate minimal price fluctuations.

- Income Generation: Traders use Short Straddles to generate income through the premiums received from selling options.

- Neutral Outlook: When investors have a neutral or non-committal outlook on an underlying asset’s price movement, Short Straddles can be an appealing choice.

How do Short Straddles Work?

The mechanics of Short Straddles involve selling both a call and a put option with the same strike price and expiration date. The strategy aims to profit from time decay as the options approach their expiration, provided the underlying asset’s price remains relatively stable. The trader collects premiums from both options, which can offset potential losses if the market remains calm.

Are Short Straddles Risky?

Short Straddles can indeed be risky due to their unlimited loss potential. If the underlying asset experiences a significant price movement, the losses incurred can be substantial. However, when used in the right market conditions and managed properly, Short Straddles can be a valuable strategy for income generation.

Are Short Straddles Bearish or Bullish?

Short Straddles are neither inherently bullish nor bearish. They are a neutral strategy that benefits from minimal price movement in the underlying asset. Traders who use Short Straddles have a non-directional outlook and are looking to profit from time decay and the stability of the underlying asset’s price.

Conclusion

In conclusion, mastering the Short Straddle strategy in options trading can provide you with a powerful tool to generate income in low-volatility markets. However, it comes with its own set of risks, including unlimited loss potential and high margin requirements.

To succeed with Short Straddles, it’s crucial to monitor your positions closely, implement risk management strategies, and choose the right market conditions. Diversifying your options trading strategies is also advisable to minimize risk.

If you’re interested in exploring Short Straddles or need assistance with options trading, feel free to message us on X.com or Discord for more support.