How to Use the Option Calculator

The purpose of the Option Calculator is to give traders a way to forecast the future price of an option based on changes in the underlying and the volatility assumptions. When using our Option Calculator traders can configure the following settings:

- Chart Type (Option market price, or your position’s PnL)

- The Contract: Call/Put, stock, expiration, strike

- The Position: Contracts, entry price

- Volatility (an assumption about the IV used in the report’s calculation of price)

Using our Option Calculator that incorporates the Black-Scholes model for speculating on future option prices can be highly beneficial for a trader due to several reasons:

-

Theoretical Pricing: The Black-Scholes model provides a theoretical estimate of the price of options given the price of the underlying, the time until expiration, and the volatility.

-

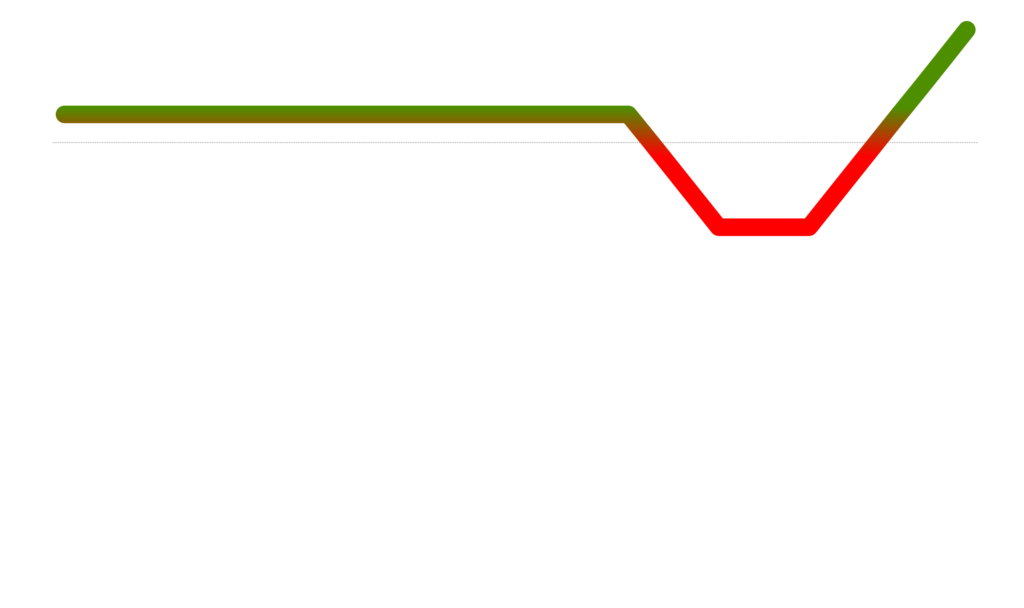

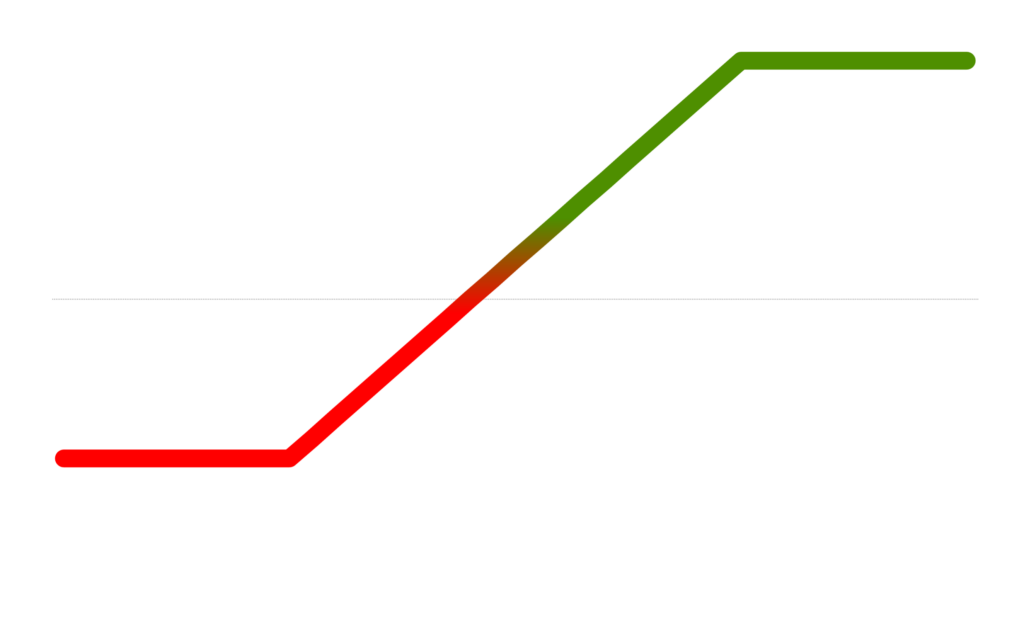

Volatility Analysis: Volatility is a critical factor in options pricing. The Black-Scholes model uses the volatility of the underlying asset to predict how it may impact the option’s price. By inputting different volatility scenarios, traders can speculate how changes in volatility may affect the option’s value.

-

Scenario Analysis: Traders can use the calculator to simulate various scenarios, including changes in the underlying asset’s price, volatility, and time to expiration. This scenario analysis can help in understanding potential outcomes and in planning exit strategies accordingly.

-

Strategic Decision Making: The calculator can aid in strategic decisions such as the timing of entry and exit, choosing between different strike prices and expiration dates, and whether to pursue strategies like hedging.

-

Time Decay Analysis (Theta): Options lose value as they approach expiration (time decay). The Black-Scholes model helps in understanding the rate of this time decay, which is vital for strategies involving time-sensitive trades.

-

Educational Tool: For less experienced traders, using an option calculator based on the Black-Scholes model can be educational, helping them understand how different factors affect option prices.

-

Consistency in Valuation: The Black-Scholes model provides a standardized way of valuing options, which is useful for comparing options across different underlying assets and time frames.

Example Use Case

It is Friday and you just bought calls on NVDA, expiring in 14 days, and earnings just came out. After hours the stock is up 8%, but the options market is closed so you can’t tell the price of your call option given this move in the underlying (and likely collapse in volatility).

A trader can open the Option Calculator, select their exact contract, and set their volatility assumption. Running the report will generate a range of potential outcomes using Black Scholes and will plot the contract’s option price in a grid.

Using this information, a trader might decide to set stop loss or limit order prices in their brokerage to close the position. Or say they didn’t have a position yet, they might decide to sell options for a credit first thing in the morning to capitalize on the expected volatility collapse.