Bull Put Ladder

Introduction to the Bull Put Ladder

The Bull Put Ladder, also known as the Put Ladder Spread, is a versatile options trading strategy with significant potential for gains when used wisely. This strategy involves the simultaneous purchase and sale of put options on the same underlying asset, making it suitable for investors who anticipate moderate bullish movements. Let’s delve deeper into the Bull Put Ladder, its components, and its relevance in options trading.

Key Takeaways

- The Bull Put Ladder is an options trading strategy that involves selling an OTM put option and buying two lower OTM put options on the same underlying asset.

- It can be a cost-efficient strategy, but commissions and fees can represent a significant portion of the premium collected.

- The margin impact depends on your broker’s requirements and the maximum potential loss of the trade.

- Benefits include defined risk, profit potential, and upfront premium collection, while risks include limited upside and margin ties.

- Traders use Bull Put Ladders in mildly bullish markets, for income generation, and when expecting lower volatility.

- This strategy is mildly bullish, profiting from moderate upward movements in the underlying asset’s price.

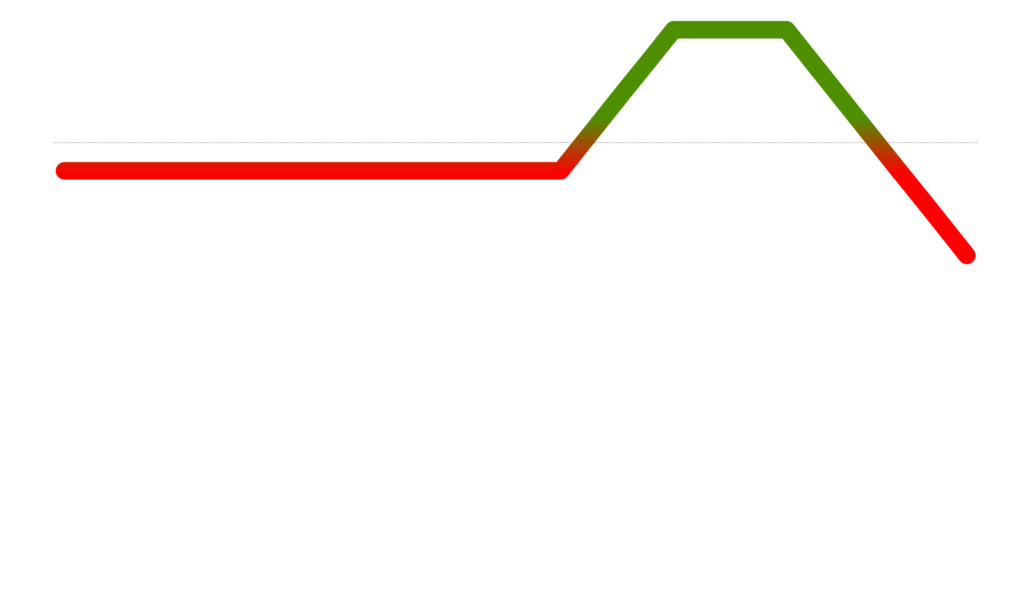

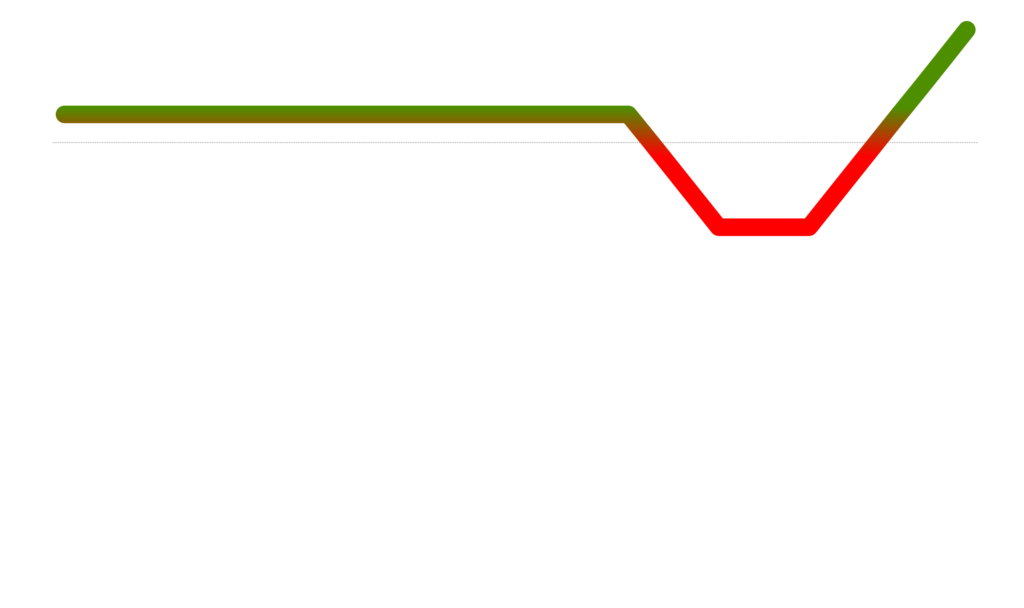

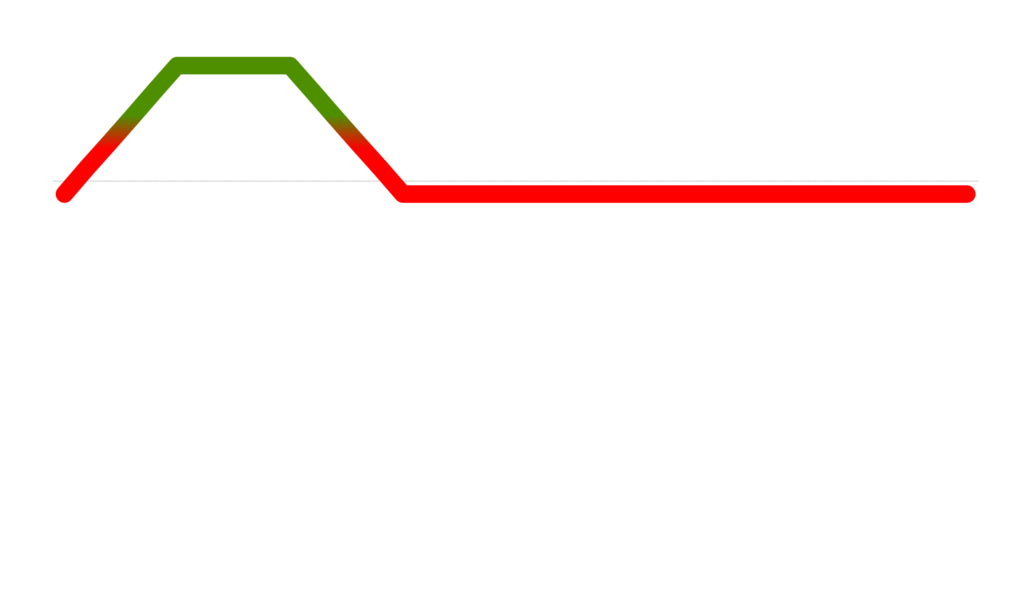

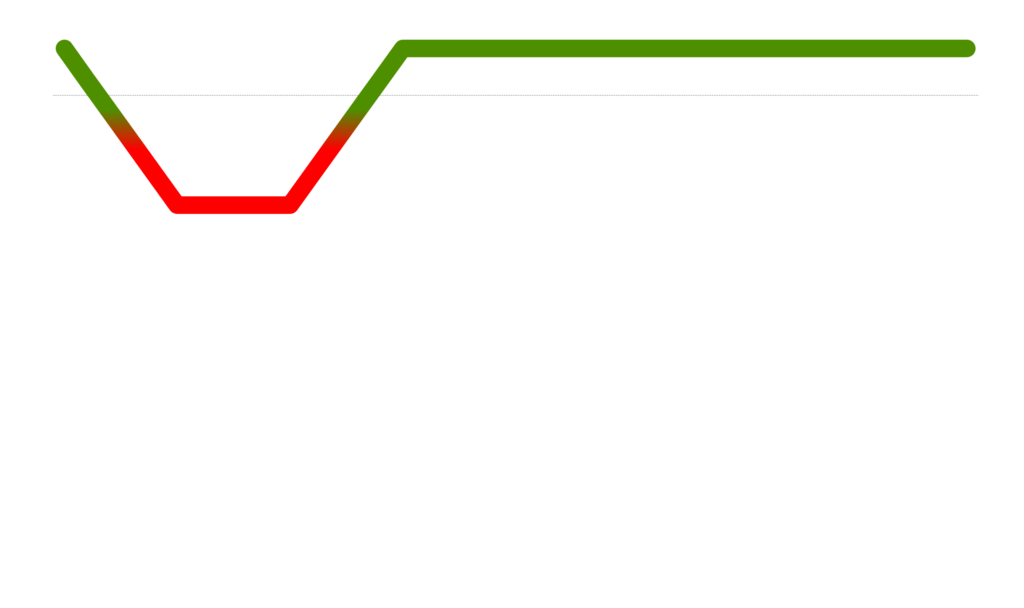

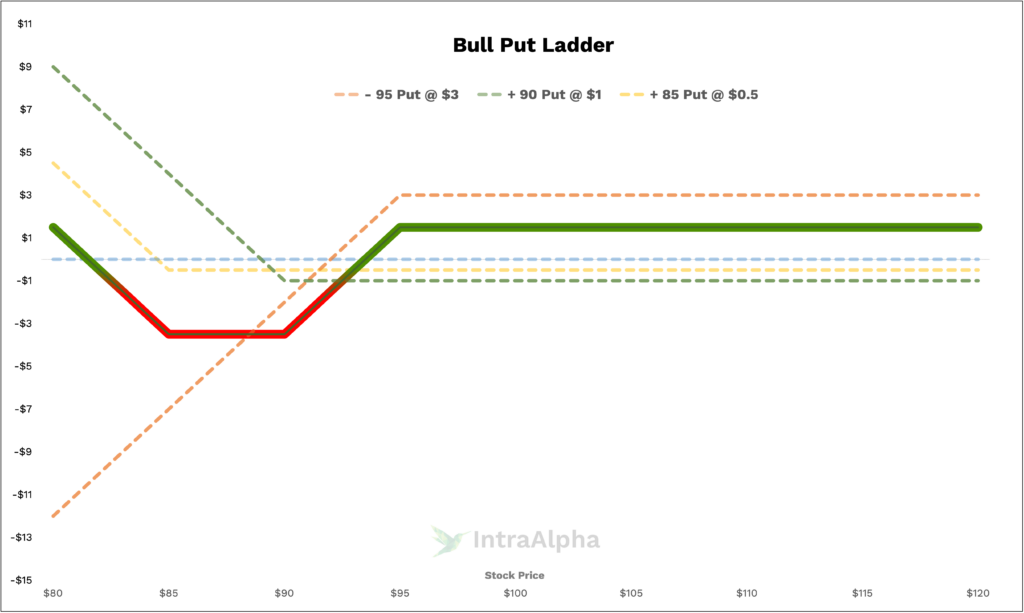

Bull Put Ladder Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Bull Put Ladders

To comprehend the Bull Put Ladder, it’s essential to grasp the core principles behind it, including the key components of calls and puts.

A put option gives the holder the right to sell an underlying asset at a predetermined strike price before or on the option’s expiration date. Conversely, a call option grants the holder the right to buy the underlying asset at a specified strike price.

In the Bull Put Ladder strategy, you start by selling an out-of-the-money (OTM) put option and simultaneously buying two lower OTM put options with different strike prices. This creates a profit zone outside the sold put and the bought puts.

Bull Put Ladder Trades

To illustrate the Bull Put Ladder strategy, consider XYZ Corporation, currently trading at $100 per share, with a 45-day option expiration. Suppose you decide to sell an XYZ $95 put option for $300. Simultaneously, you buy an XYZ $90 put for $100 and another XYZ $85 put for $50.

Premium Collected = $300 (from selling the $95 put). Premium Spent = $100 (from buying the $90 put) + $50 (from buying the $85 put). Total Premium Collected = $300 – ($100 + $50) = $150.

In this example, you collect a total premium of $150 for the trade. Your maximum loss is capped at the difference between the strikes of the sold ($95) and bought ($90) puts, minus the premium collected, which is $150, thus $500 – $150 = $350.

Commissions and Fees with Bull Put Ladders

Understanding the costs associated with the Bull Put Ladder strategy is crucial. Relative to other option trading strategies, Bull Put Ladders can be relatively cost-efficient.

Assuming a $1 fee per leg for a round trip trade, you would incur a total commission cost of $6 ($1 for selling the $95 put, $1 for buying the $90 put, and $1 for buying the $85 put).

To put this cost into perspective, if you collected a total premium of $150 as in the previous example, your fees would represent approximately 4% of your total premium.

Margin Impact of Bull Put Ladders

The margin impact of a Bull Put Ladder strategy depends on the specific broker and their margin requirements. Generally, your broker will reserve margin based on the maximum potential loss of the trade.

For instance, if XYZ Corporation is trading at $100 and you execute the Bull Put Ladder as described earlier, your broker may reserve margin based on the maximum loss of $350 per trade.

Benefits and Risks of Bull Put Ladders

Before engaging in any options trading strategy, it’s essential to weigh the benefits and risks involved.

Benefits:

- Defined risk: Bull Put Ladders have a capped maximum loss, making them suitable for risk-conscious traders.

- Profit potential: If the underlying asset moves in the desired direction, profits can be substantial.

- Credit received: Collecting a premium upfront can provide immediate income.

Risks:

- Limited upside: Gains are capped to the upside, as the strategy is designed for moderate bullish movements.

- Margin requirements: Brokers may tie up a significant amount of capital as margin.

- Market conditions: Bull Put Ladders are most effective in stable or slightly bullish markets. Sharp market reversals can lead to losses.

Proven Tips for Success with Bull Put Ladders

To increase your chances of success with Bull Put Ladders, consider the following tips:

- Adequate research: Carefully analyze the underlying asset and market conditions before implementing this strategy.

- Diversification: Avoid concentrating your trades solely on one underlying asset to spread risk.

- Risk management: Set stop-loss orders to limit potential losses.

- Monitor positions: Keep a close eye on your Bull Put Ladder positions and adjust as necessary.

Real-Life Bull Put Ladder Examples

Let’s examine some real-world scenarios involving Bull Put Ladders, using the XYZ Corporation example mentioned earlier:

Scenario 1: Bullish Outcome If XYZ Corporation’s stock price rises steadily, the options expire worthless, and you keep the premium collected, resulting in a profit.

Scenario 2: Neutral Outcome If XYZ’s stock price remains relatively unchanged or decreases slightly, you can still profit or break even, depending on the premium collected.

Scenario : Moderately Bearish Outcome If XYZ’s stock price decreases moderately, and stays between the bought put’s strike price, the trade results in a loss. If the stock price decreases significantly below the lowest put option, you can still profit.

When and Why Traders Use Bull Put Ladders

Traders typically employ Bull Put Ladders in the following situations:

- Mildly bullish market: When they expect the underlying asset to experience a modest upward movement.

- Income generation: To collect premium income while limiting downside risk.

- Volatility expectations: In anticipation of lower volatility, as this strategy thrives in calmer markets.

How do Bull Put Ladders Work?

The Bull Put Ladder involves selling an OTM put option and buying two lower OTM put options. This creates a profit zone slightly above the sold put. If the underlying asset’s price remains above the short put at expiration, the options expire worthless, and you keep the premium collected.

Are Bull Put Ladders Risky?

Like all trading strategies, Bull Put Ladders carry risks. The primary risk is limited downside potential, as the strategy is designed for moderate bullish movements. Additionally, the margin requirements can tie up a significant amount of capital, and sharp market reversals can lead to losses.

Are Bull Put Ladders Bearish or Bullish?

Bull Put Ladders are a mildly bullish strategy. They profit from moderate upward movements in the underlying asset’s price while offering downside protection.

Conclusion

In conclusion, the Bull Put Ladder strategy can be a valuable tool for options traders seeking to profit from moderate bullish movements while managing risk. Understanding its mechanics, benefits, and risks is crucial for successful implementation. Remember that this strategy, like all trading approaches, requires careful analysis and risk management. As you explore the world of options trading, mastering the Bull Put Ladder can add a valuable tool to your arsenal. If you need further assistance with trading strategies, feel free to message us on X.com or Discord for more support.