Bull Call Ladder

Introduction to the Bull Call Ladder

Options trading has gained immense popularity among investors seeking to diversify their portfolios and manage risk. One intriguing strategy that frequently comes up in options discussions is the Bull Call Ladder. This versatile strategy goes by various names, including the Long Call Ladder, and it shares traits with the Call Ratio Backspread, and Call Debit Spread. In this article, we will explore the intricacies of the Bull Call Ladder, shedding light on its core concepts, execution, benefits, and potential risks.

Key Takeaways:

- Bull Call Ladders are a versatile options trading strategy suitable for moderately bullish market conditions.

- This strategy involves a combination of long and short call options on the same underlying asset.

- While it offers limited profit potential, it comes with a controlled risk profile.

- Bull Call Ladders can generate income through premium collection but require careful analysis and monitoring.

- Understanding the strategy’s mechanics, costs, and risks is essential before implementation.

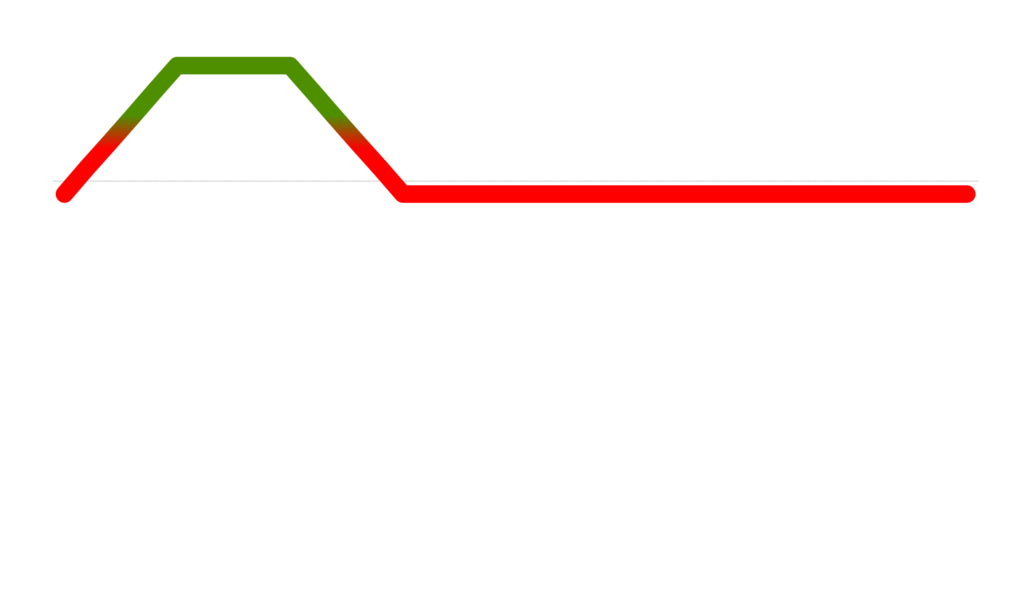

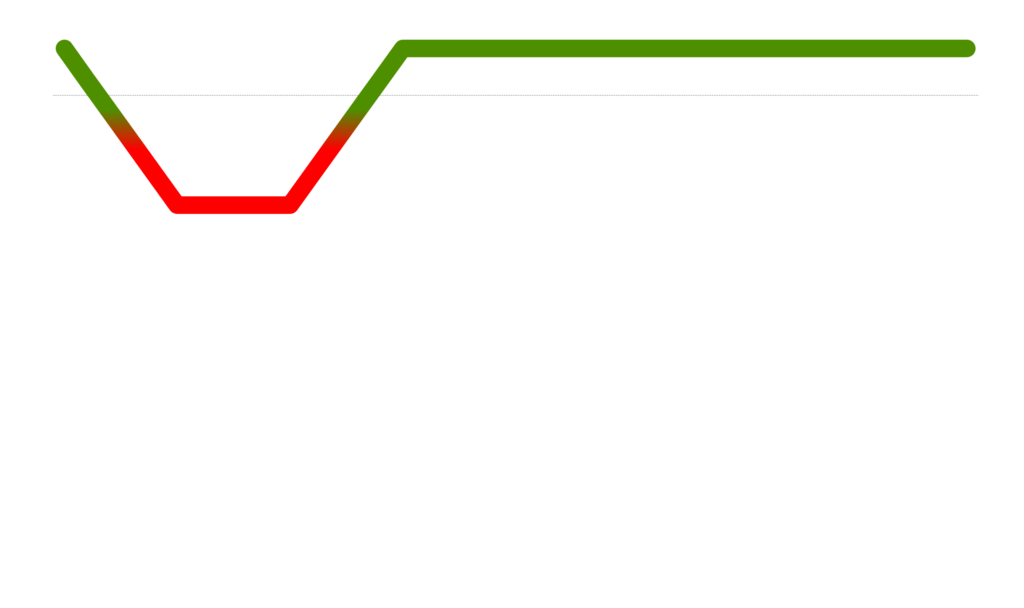

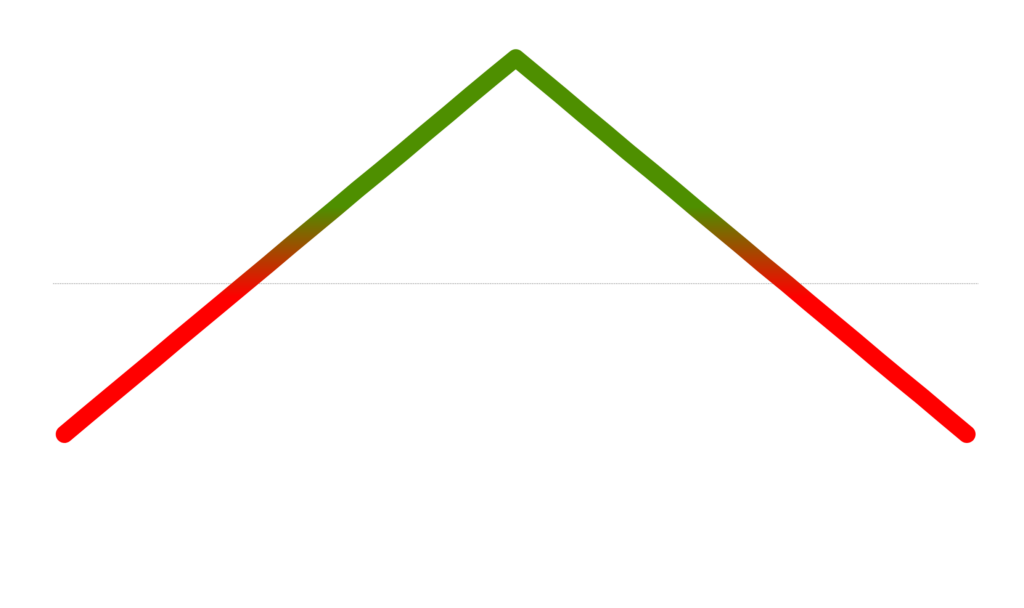

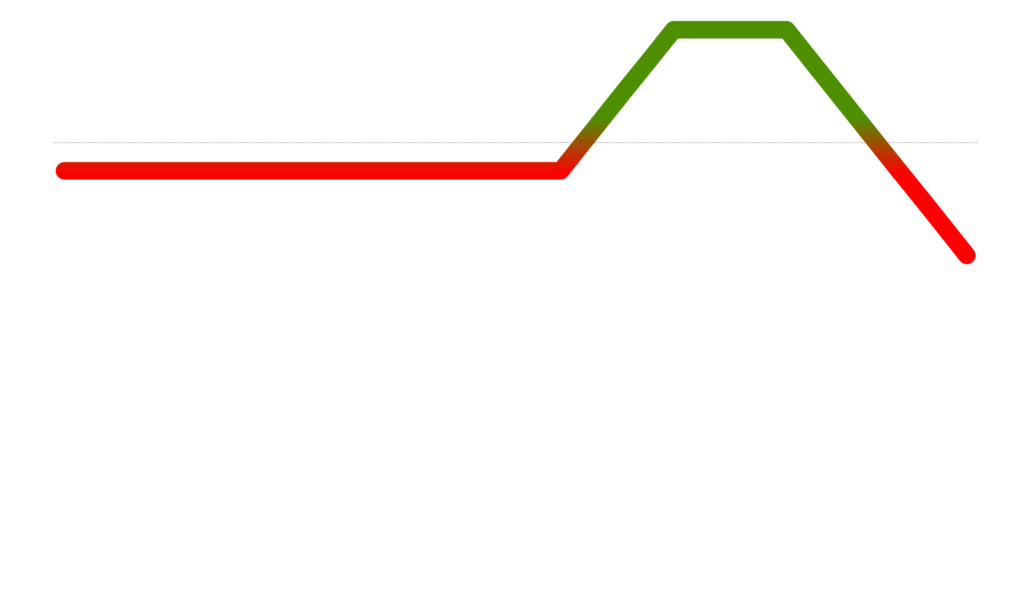

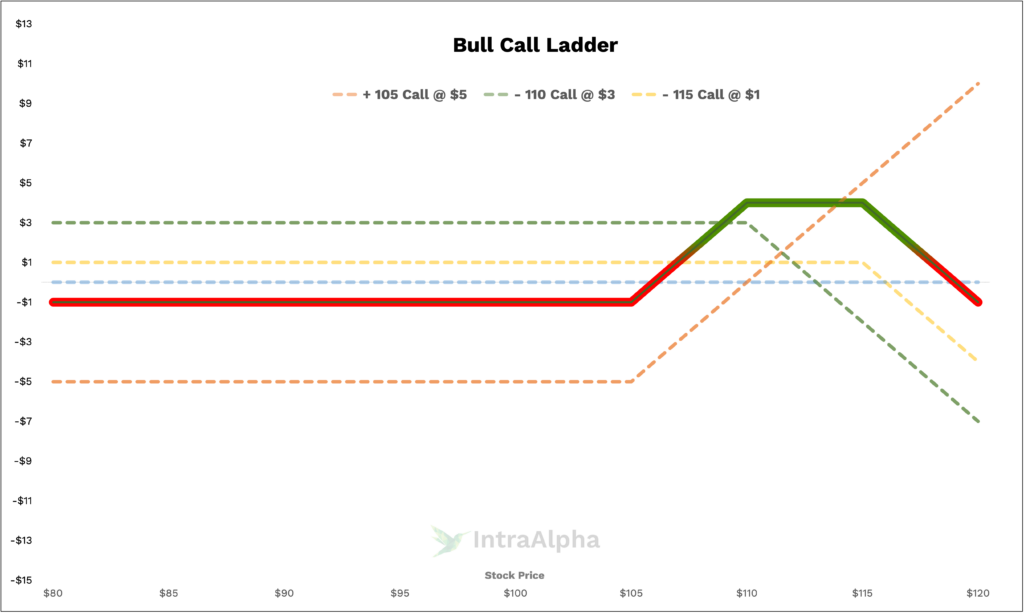

Bull Call Ladder Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Bull Call Ladders

The Bull Call Ladder is an options trading strategy that involves a combination of long and short call options on the same underlying asset. It is essential to grasp the fundamentals of call options before diving into this strategy. A call option grants the holder the right, but not the obligation, to buy the underlying asset at a specified strike price before the option’s expiration date.

In a Bull Call Ladder, an investor typically:

- Buys one lower strike call option.

- Sells one higher strike call option.

- Sells one higher strike call option.

This configuration creates a profit zone that benefits from a moderately bullish move in the underlying asset while limiting potential losses. It offers a unique risk-reward profile compared to simpler call strategies.

Long Bull Call Trades

To better understand the Bull Call Ladder, let’s consider a practical example with XYZ Corporation. Suppose XYZ is currently trading at $100, and you decide to execute a Bull Call Ladder strategy expiring in 45 days.

- Buy one XYZ call option with a strike price of $105.

- Sell one XYZ call option with a strike price of $110.

- Sell one XYZ call option with a strike price of $115.

In this trade, you will collect a premium for selling two call options while paying for the purchase of one. The net premium spent depends on the market conditions and strike selection. This premium is a key factor in determining the trade’s potential profitability.

Commissions and Fees with Bull Call Ladders

When considering the cost and fees associated with Bull Call Ladders, it’s essential to compare them to other option trading strategies. Typically, options trading incurs fees for both buying and selling contracts. Assuming a $1 fee per leg (buying and selling), a round trip trade for a Bull Call Ladder would cost $6 in commissions.

To evaluate the significance of these fees, consider the premium collected or spent in total for the trade. If, for instance, the net premium paid for our XYZ trade is $100, the $6 in fees would account for 6% of the trade’s total cost. This percentage highlights the importance of efficient fee management in options trading, particularly when executing complex strategies like Bull Call Ladders.

Margin Impact of Bull Call Ladders

The margin impact of a Bull Call Ladder can significantly affect your available capital. When implementing this strategy, brokers typically require investors to maintain margin requirements for both the bought and sold options. Using the XYZ example, the total margin requirement for the trade would be for instance $3,000.

This margin impact underscores the importance of understanding your broker’s margin requirements and having adequate capital to support Bull Call Ladder positions.

Benefits and Risks of Bull Call Ladders

Benefits:

- Limited Risk: Bull Call Ladders offer a capped risk as the maximum loss occurs if the underlying asset’s price falls below the lowest strike price.

- Profit Potential: There is profit potential in both bullish and neutral market scenarios, making it a versatile strategy.

- Income Generation: The strategy can generate income through the premiums collected from selling call options.

Risks:

- Unlimited Risk: The strategy’s loss potential is unlimited if the stock price moves substantially above the highest strike price.

- Breakeven Points: Bull Call Ladders have multiple breakeven points, making it challenging to predict profitability.

- Market Volatility: Rapid price movements can negatively impact the trade’s performance.

Proven Tips for Success with Bull Call Ladders

To increase your chances of success with Bull Call Ladders, consider these practical tips:

- Thorough Analysis: Carefully analyze the market conditions and underlying asset’s behavior before implementing the strategy.

- Adequate Capital: Ensure you have sufficient capital to meet margin requirements and manage potential losses.

- Monitor Positions: Keep a close eye on your positions and adjust them if market conditions change significantly.

Real-Life Bull Call Ladder Examples

Let’s examine real-world scenarios using our XYZ Corp example:

Scenario 1: Bullish Move

- XYZ’s price rises to $111 at expiration.

- The options with strike prices of $115 expire worthless.

- The options with strike prices of $105 and $110 have intrinsic value.

- The profit is the difference between the intrinsic value of these options, minus the premium paid.

Scenario 2: Neutral to Bearish Move

- XYZ’s price remains at $105 or lower at expiration.

- The options with strike prices of $105, $100 and $115 expire worthless.

- None of the options would have intrinsic value.

- The strategy results in a small net loss of $100, exactly the premium paid.

When and Why Traders Use Bull Call Ladders

Traders often employ Bull Call Ladders in specific market conditions:

- Mildly Bullish Outlook: When they expect a moderately bullish move in the underlying asset.

- Range-Bound Markets: In scenarios where they anticipate the asset’s price to stay within a certain range.

- Limited Downside Risk Tolerance: For investors seeking to limit potential losses while maintaining profit potential.

The key motivation behind using Bull Call Ladders is the expectation of a gradual or moderate increase in the underlying asset’s price, combined with the strategy’s ability to generate income through premium collection.

How do Bull Call Ladders Work?

Bull Call Ladders work by creating a structured combination of long and short call options. The long call option with the lowest strike price provides potential profit in a bullish move, while the short call options with higher strike prices help offset the cost of the strategy by collecting premiums. The second long call with the highest strike price limits potential losses.

Are Bull Call Ladders Risky?

Bull Call Ladders come with their own set of risks, as do all options strategies. The main risk lies in the limited profit potential and the need for the underlying asset to move in the desired direction moderately. Additionally, the strategy involves multiple breakeven points, making it challenging to predict outcomes accurately.

Are Bull Call Ladders Bearish or Bullish?

Bull Call Ladders are inherently bullish strategies. They profit from a rise in the underlying asset’s price, making them suitable for investors with a moderately bullish outlook.

Conclusion

In conclusion, mastering the Bull Call Ladder strategy can be a valuable addition to your options trading toolkit. While it offers limited profit potential, it also provides a controlled risk profile, making it attractive for investors looking to navigate a moderately bullish market. However, it is crucial to understand the strategy’s mechanics, costs, and risks before implementation.

If you’re ready to explore the world of options trading and need further guidance or support, don’t hesitate to message us on X.com or Discord. Our team is here to assist you on your journey towards becoming a more informed and successful trader.