Short Strangle

Introduction to the Short Strangle

In the realm of options trading, the Short Strangle strategy is a versatile and powerful tool that traders employ to capitalize on market volatility. This strategy is known by other names such as “Naked Strangle” or simply “Strangle.” It is a non-directional options strategy that involves selling an out-of-the-money (OTM) call and an OTM put with the same expiration date. The purpose of this article is to provide a detailed understanding of the Short Strangle strategy, how it works, its applications, and the associated benefits and risks.

Key Takeaways

- A Short Strangle involves selling an out-of-the-money call and an out-of-the-money put with the same expiration date.

- The strategy thrives on volatility and aims to profit from time decay.

- Trading fees and margin requirements can impact the cost-effectiveness of Short Strangles.

- Benefits include a high probability of profit and time decay advantage, while risks include unlimited losses and margin requirements.

- Traders use Short Strangles in low-volatility environments and before earnings announcements.

- The strategy is neither inherently bearish nor bullish; it profits from limited price movement within a defined range.

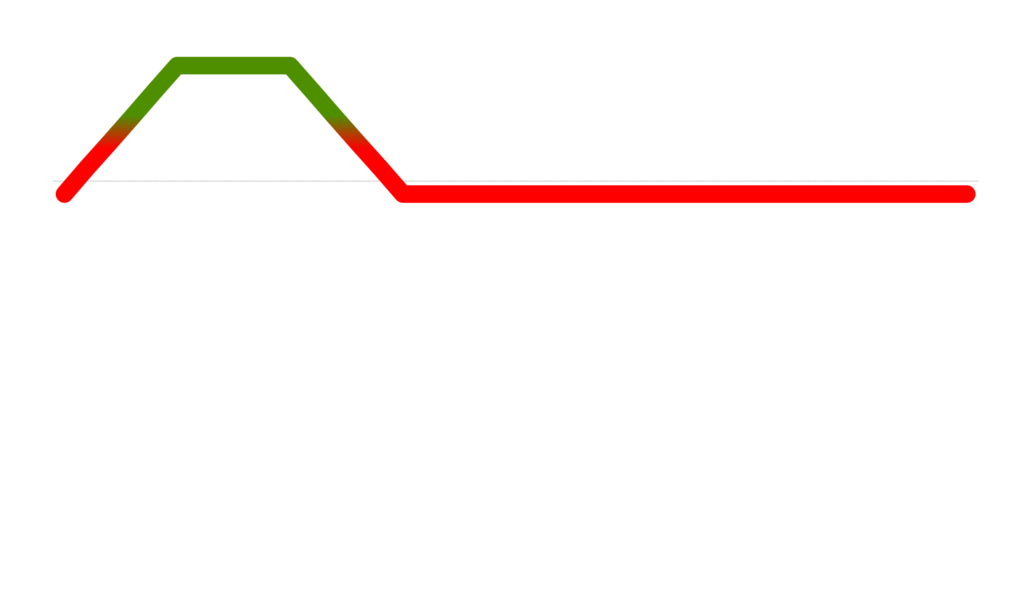

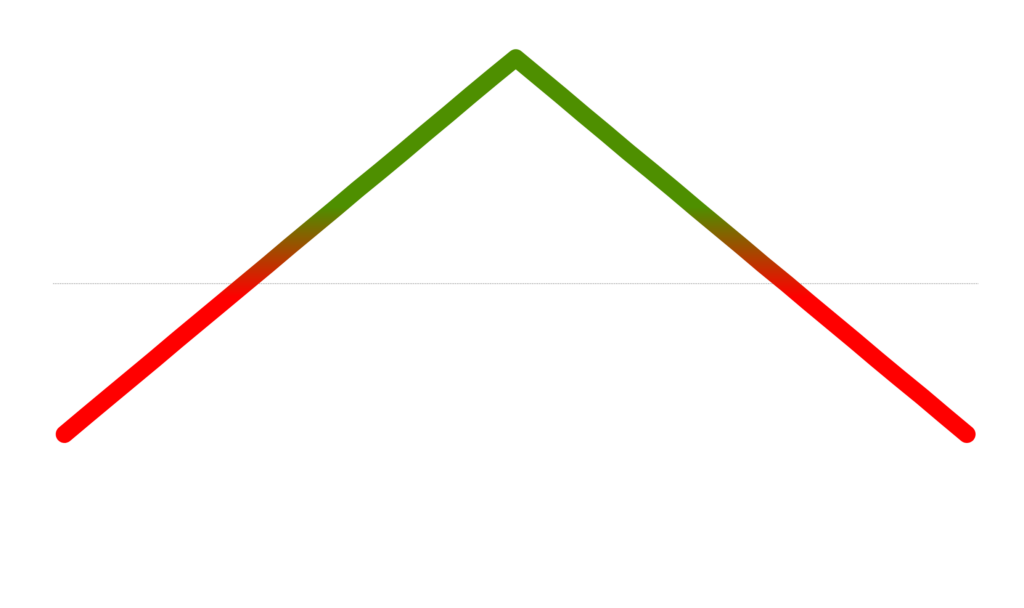

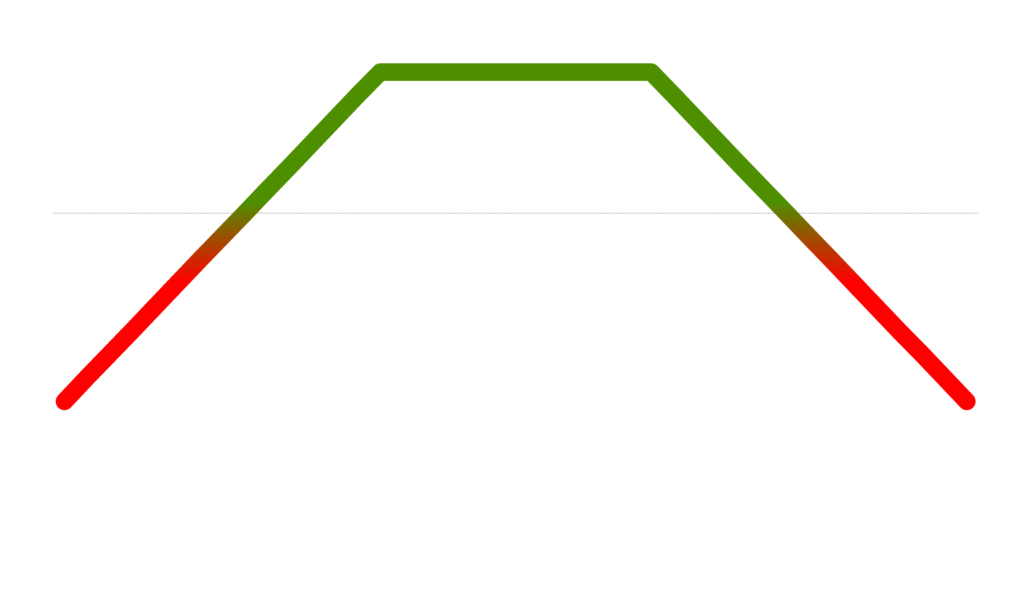

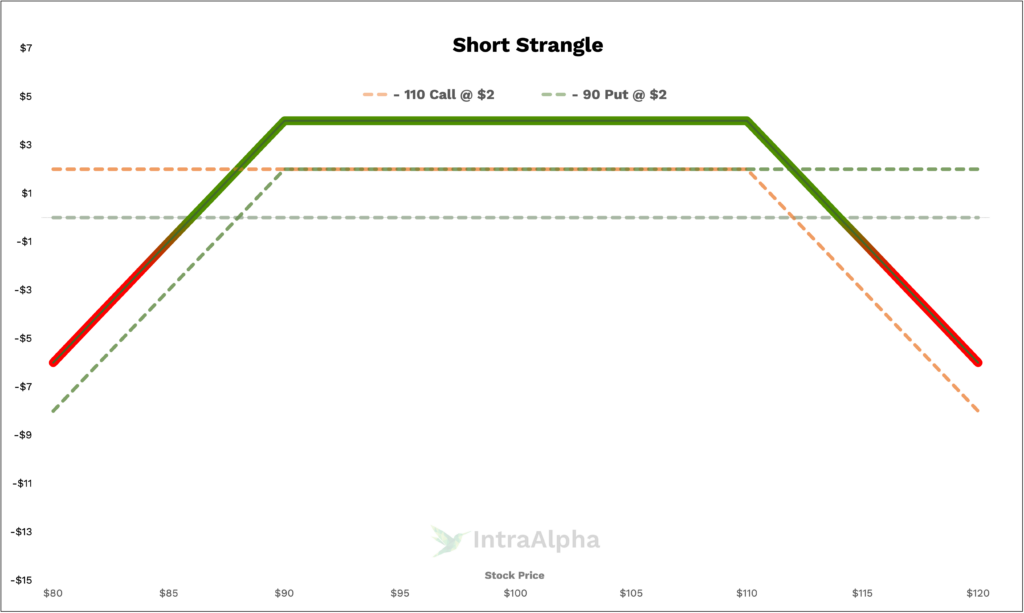

Short Strangle Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Short Strangles

A Short Strangle involves two key components: selling a call option and selling a put option, both with the same expiration date but at different strike prices. The call option is typically sold above the current market price (out-of-the-money), while the put option is sold below the market price. This strategy thrives on volatility and aims to profit from the time decay of options.

Short Strangle Trades

Let’s illustrate this strategy with an example involving XYZ Corporation. Suppose XYZ is currently trading at $100, and you decide to execute a Short Strangle with a 45-day expiration. You sell an XYZ $110 call for $200 and an XYZ $90 put for $200. The total premium collected in this example would be $400 ($200 from the call and $200 from the put). This premium represents the maximum profit potential for the trade.

Commissions and Fees with Short Strangles

Trading Short Strangles can entail varying costs and fees, depending on your brokerage. Typically, brokers charge fees for executing each leg of the trade. Assuming a fee of $1 for each leg, a round-trip trade (opening and closing positions) would incur $4 in fees ($2 for the call and $2 for the put). In this example, these fees represent 1% of the total premium collected.

Margin Impact of Short Strangles

The margin impact of a Short Strangle strategy can vary depending on the broker and the specific requirements they impose. Suppose, in our XYZ example, the broker requires a margin of $2,000 to maintain this position. The impact on your available margin, considering XYZ’s current price of $100, would be to reduce your available margin by the requirement of $2,000.

Benefits and Risks of Short Strangles

Benefits:

- High Probability of Profit: Short Strangles can generate a profit if the underlying asset remains within a certain price range until expiration.

- Time Decay Advantage: The strategy benefits from the erosion of time value in both the call and put options.

- Flexibility: Traders can adjust or close positions to manage risk or capture profits.

Risks:

- Unlimited Losses: Unlike some strategies, Short Strangles have unlimited loss potential, as there is no cap on how high or low the underlying asset’s price can go.

- Margin Requirements: Brokers may impose substantial margin requirements, limiting the capital available for other trades.

- Volatility: Sudden and significant price movements in the underlying asset can result in substantial losses.

Proven Tips for Success with Short Strangles

To increase your chances of success when trading Short Strangles, consider the following tips:

- Monitor Positions Regularly: Keep a close eye on your positions and be prepared to adjust or close them if the market moves significantly.

- Diversify: Avoid concentrating all your capital in a single Short Strangle position. Diversification can help manage risk.

- Set clear exit rules: Determine your profit target and stop-loss levels before entering a trade to maintain discipline.

Real-Life Short Strangle Examples

Let’s delve into real-life scenarios to illustrate the Short Strangle strategy further. Suppose XYZ Corp is set to announce earnings in a few weeks, and you expect limited price movement leading up to the earnings release. In such a scenario, you might opt to execute a Short Strangle, selling out-of-the-money call and put options. If XYZ’s stock price remains relatively stable, the options will lose value due to time decay, resulting in a profit.

When and Why Traders Use Short Strangles

Traders employ the Short Strangle strategy under specific market conditions and with distinct objectives:

- Low Volatility: Short Strangles are often used when traders anticipate low volatility and expect the underlying asset to remain within a certain price range.

- Income Generation: Traders use this strategy to generate income through the premiums collected from selling call and put options.

- Earnings Season: Short Strangles can be beneficial before significant corporate earnings announcements, where traders anticipate minimal price movement.

- Neutral Outlook: When traders have a neutral outlook on the underlying asset and believe it will not experience substantial price swings, a Short Strangle can capitalize on this stability.

How do Short Strangles Work?

The mechanics of a Short Strangle are straightforward. By selling both a call and a put option with different strike prices but the same expiration date, you create an obligation to potentially buy (in the case of the put) or sell (in the case of the call) the underlying asset at those strike prices. Your profit or loss is determined by the difference between the premium collected and any potential adjustments required to manage the position.

Are Short Strangles Risky?

Short Strangles carry inherent risks due to their unlimited loss potential. If the underlying asset makes a substantial and unexpected move in either direction, your losses can be significant. Additionally, margin requirements and fees can eat into profits or exacerbate losses. It is essential to fully understand these risks and employ risk management strategies when trading Short Strangles.

Are Short Strangles Bearish or Bullish?

Short Strangles are non-directional strategies, meaning they are neither inherently bearish nor bullish. Instead, they profit from limited price movement within a defined range. The key to success with Short Strangles is a stable underlying asset and low volatility.

Conclusion

In conclusion, the Short Strangle strategy is a versatile tool in the options trader’s arsenal. It offers the potential for profit in low-volatility environments and can be used strategically during earnings seasons. However, it comes with substantial risks, including unlimited losses and margin requirements.

Mastering the Short Strangle strategy requires a deep understanding of its mechanics, risk management, and market conditions. As with any trading strategy, success comes with experience and discipline. If you’re interested in exploring the Short Strangle further or need assistance with options trading, message us on X.com or Discord for more support.