Calendar Call Spread

Introduction to the Calendar Call Spread

The Calendar Call Spread, also known as a horizontal or time spread, is a significant strategy in the realm of options trading. This approach is lauded for its strategic application in various market conditions, offering traders a unique method to potentially capitalize on time decay and volatility discrepancies.

Key Takeaways

- Calendar Call Spreads involve buying and selling call options of the same strike price but different expirations.

- Ideal in low-to-moderate volatility markets, expecting minimal stock movement.

- Commissions and fees are moderate, with careful consideration needed for margin requirements.

- Risks include significant market movements and volatility changes.

- Strategy is neutral to slightly bullish, focusing on time decay differential.

- Success hinges on selecting appropriate strike prices, expiration dates, and market analysis.

Understanding Calendar Call Spreads

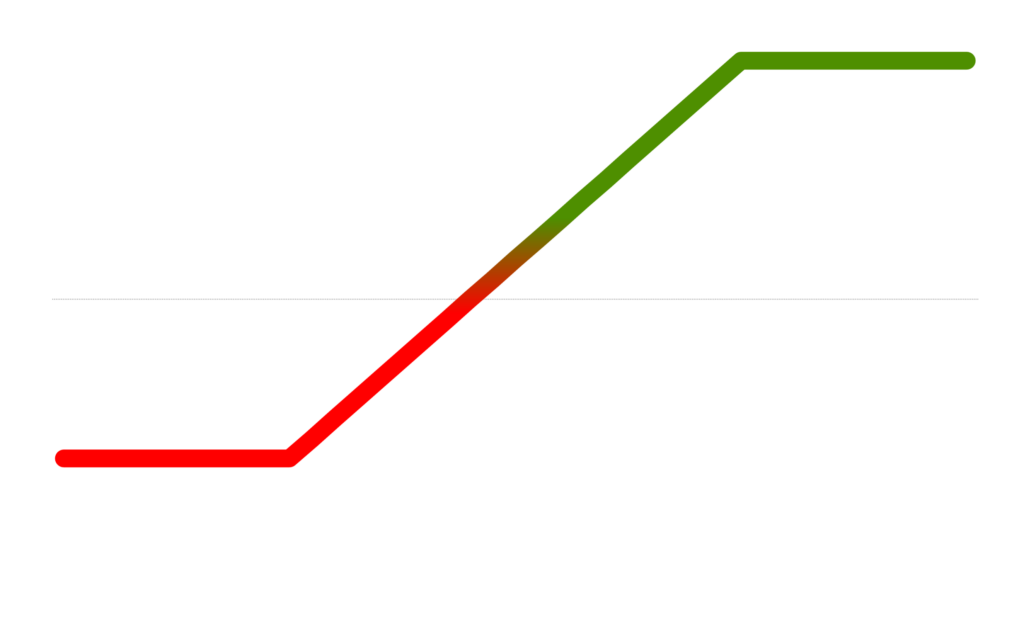

A Calendar Call Spread involves buying and selling call options with the same strike price but different expiration dates. The strategy is built on the premise that the value of the short-term option will decay at a faster rate than the long-term option, potentially allowing traders to profit from this differential.

Long Calendar Call Trades

In a practical scenario, let’s consider XYZ Corp trading at $100. A trader might execute a long Calendar Call Spread by purchasing a call option with a 45-day expiry for a premium of $400 and simultaneously selling a call option with a shorter expiry for $150. The total premium paid stands at $250. This strategy’s success hinges on the short-term option expiring worthless, while retaining value in the long-term option.

Commissions and Fees with Calendar Call Spreads

Comparatively, Calendar Call Spreads are moderately priced in terms of commissions and fees. Assuming a $1 fee per leg, a round-trip trade would cost $4. In the XYZ Corp example, this fee constitutes a minor 1.6% of the total $250 premium. This cost-effectiveness makes the strategy an attractive option for traders mindful of expenses.

Margin Impact of Calendar Call Spreads

With XYZ Corp at $100, the margin requirement in a Calendar Call Spread is primarily influenced by the short call position. It necessitates sufficient margin to cover potential losses, which could restrict the trader’s ability to engage in other trades.

Benefits and Risks of Calendar Call Spreads

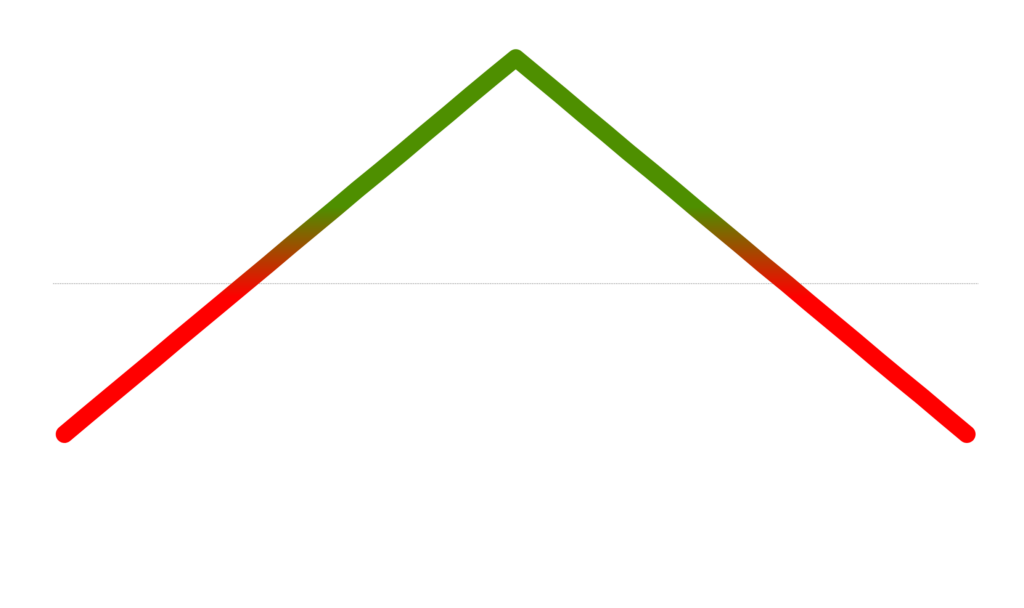

The Calendar Call Spread offers the benefit of potential profit in markets with minimal movement. However, it carries risks, such as significant movements in the underlying stock price or unexpected volatility shifts, which can adversely impact the position.

Proven Tips for Success with Calendar Call Spreads

To succeed with Calendar Call Spreads, it’s crucial to monitor market volatility, select appropriate strike prices and expiration dates, and stay updated on the underlying stock’s performance. This strategic vigilance can enhance the chances of success.

Real-Life Calendar Call Spread Examples

Using the XYZ Corp example, a trader may profit if the stock price remains around $100, allowing the short-term call to expire worthless. However, if the stock price moves significantly, it may necessitate strategy adjustments, like rolling out the short call.

When and Why Traders Use Calendar Call Spreads

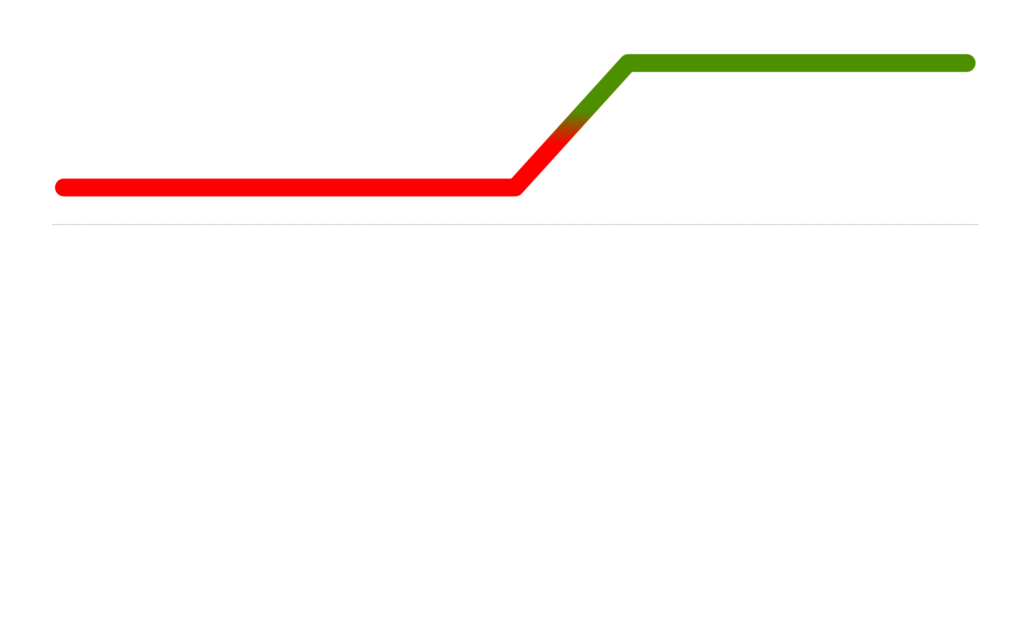

Traders often employ Calendar Call Spreads in low-to-moderate volatility markets, expecting slight movements in the stock price. The strategy is used to leverage the differential decay rates of short and long-term options.

How do Calendar Call Spreads Work?

This strategy operates on the principle of differential time decay in options. The trader benefits when the short-term option decays at a faster rate than the long-term option, potentially leading to a profitable spread difference.

Are Calendar Call Spreads Risky?

While Calendar Call Spreads can offer strategic advantages, they come with inherent risks. Market movements contrary to the trader’s expectations can lead to losses. However, the risk is often balanced with the potential for reward, making it a considered choice for experienced traders.

Are Calendar Call Spreads Bearish or Bullish?

Calendar Call Spreads are generally considered a neutral to slightly bullish strategy. They work best in markets with little expected movement or a gradual increase in the underlying stock’s price.

Conclusion

The Calendar Call Spread is a nuanced and potentially profitable strategy in options trading. Understanding its mechanics, risks, and appropriate application is crucial for traders looking to diversify their trading strategies. For further guidance and support in mastering this strategy, traders are encouraged to connect with us on X.com or Discord.