Long Put Butterfly

Introduction to the Long Put Butterfly

The Long Put Butterfly is a sophisticated options trading strategy that stands out in the complex world of financial instruments. This approach, sometimes referred to as the “Put Butterfly Spread,” is a favorite among traders seeking to profit from minimal price movements in the underlying asset.

Key Takeaways

- The Long Put Butterfly is a neutral strategy best suited for stable markets.

- It involves buying and selling puts at different strike prices to limit risk.

- Ideal when the stock price is near the middle strike price at expiration.

- Fees and margin requirements are generally lower compared to other strategies.

- Success depends on precise execution, timing, and market stability.

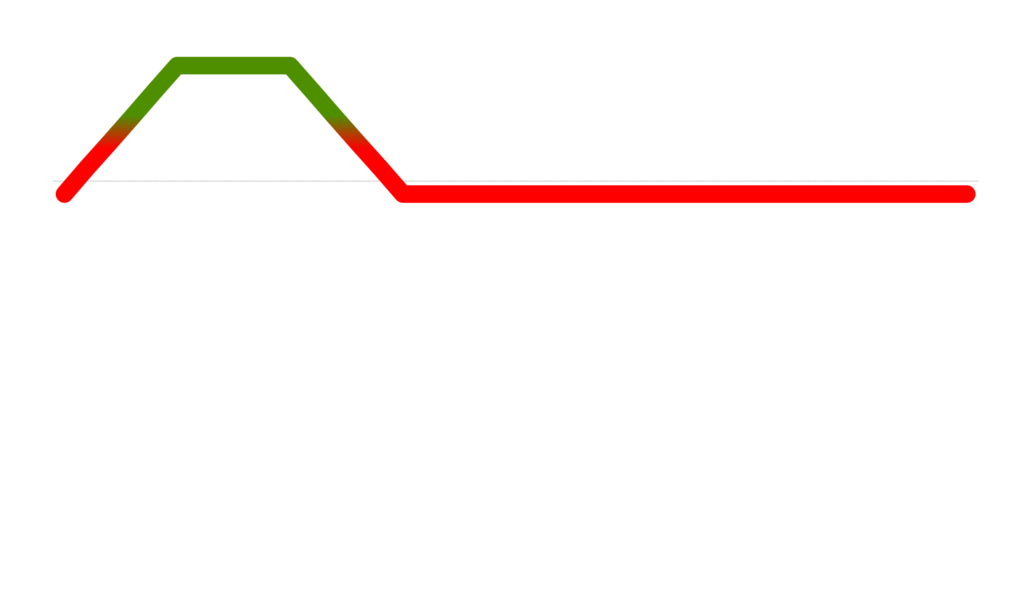

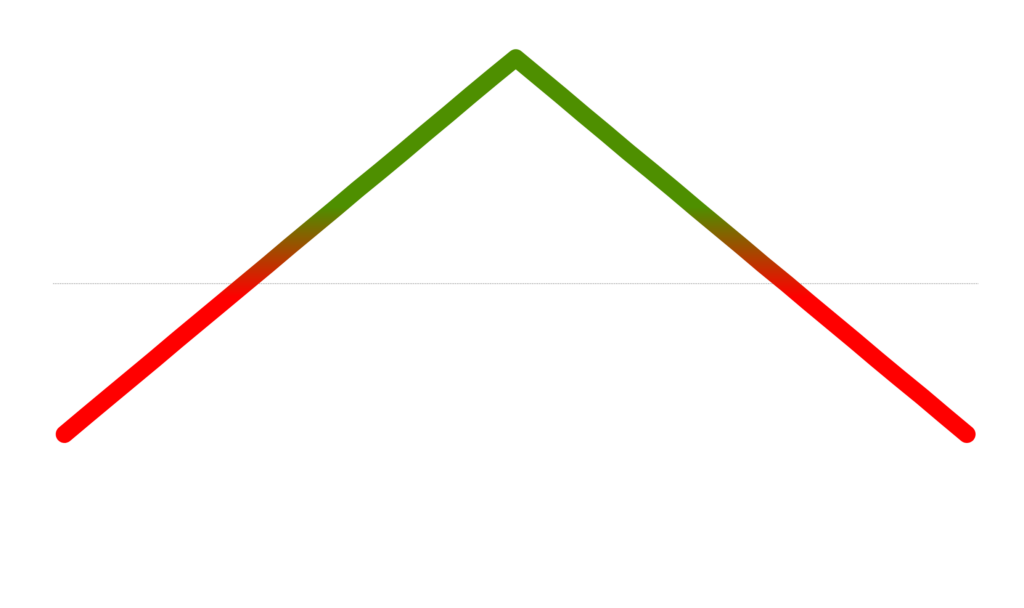

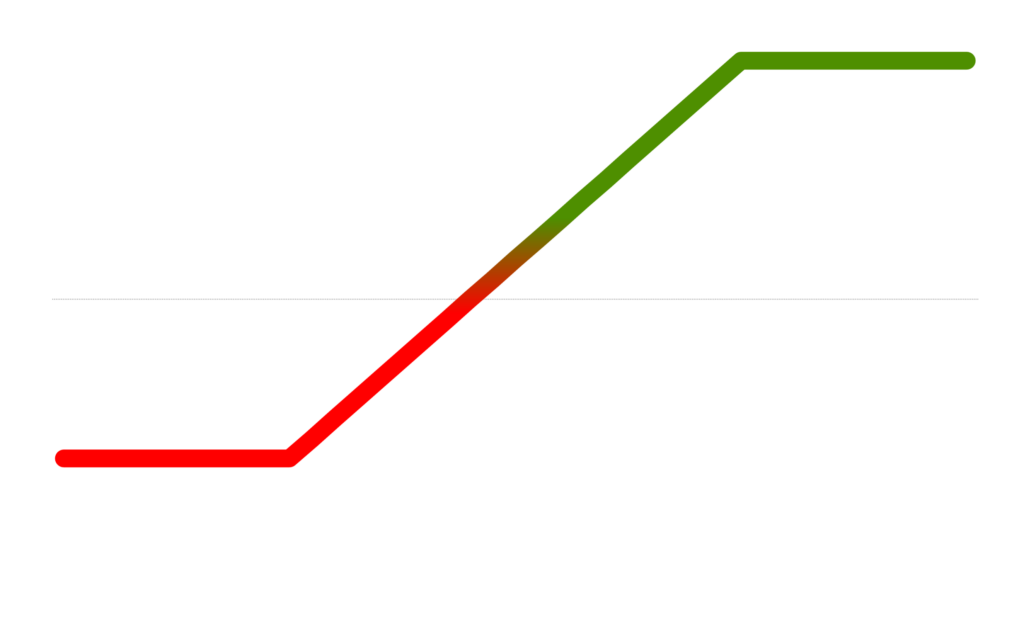

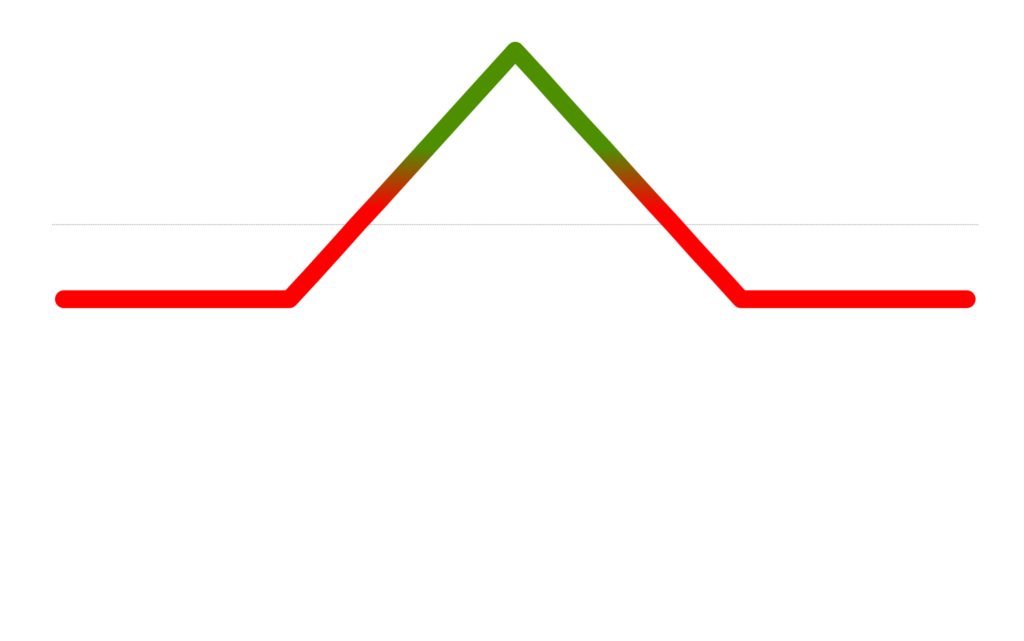

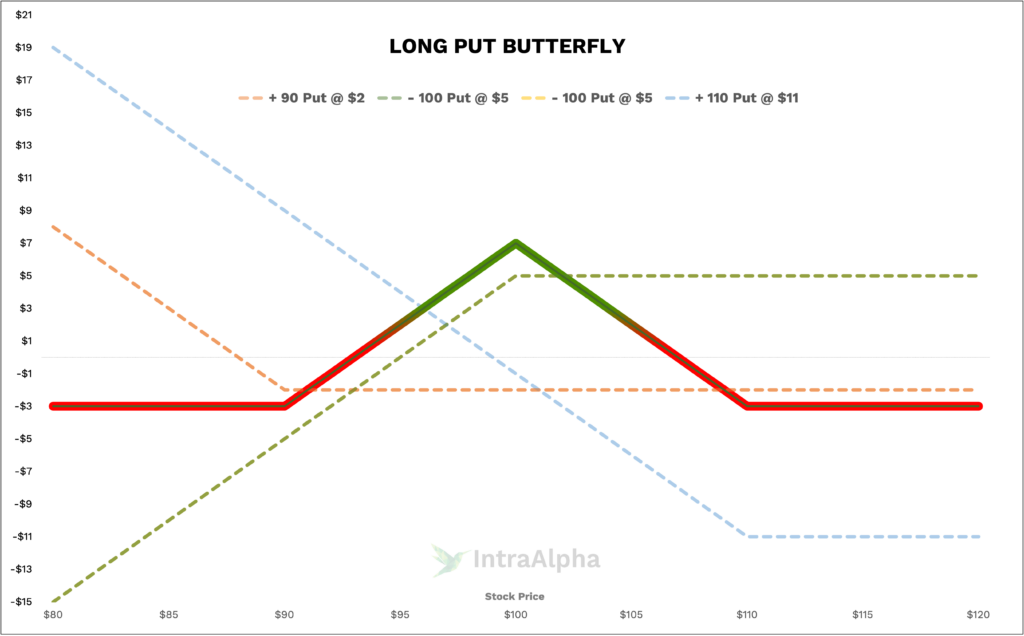

Long Put Butterfly Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Long Put Butterflies

At its core, the Long Put Butterfly involves buying and selling put options at different strike prices. It’s structured by purchasing one in-the-money put, selling two at-the-money puts, and buying one out-of-the-money put. This arrangement creates a “wingspread” that limits both the potential gain and loss, encapsulating a moderate market view.

Long Put Butterfly Trades

Executing a Long Put Butterfly requires precision. Consider XYZ Corp, trading at $100. A trader might buy a 90 strike put, sell two 100 strike puts, and buy a 110 strike put, all expiring in 45 days. The premium paid could be, for instance, $300, a strategic sum that balances risk and reward.

Commissions and Fees with Long Put Butterflies

Trading Long Put Butterflies can incur varying costs. If each leg of the trade carries a $1 fee, the round-trip cost would be $8. Compared to other strategies, this is relatively cost-effective. For our XYZ Corp example, if the total premium is $300, the fees would constitute about 2.66% of the trade’s total value.

Margin Impact of Long Put Butterflies

Margin requirements for a Long Put Butterfly are typically less onerous than for other strategies. Using our XYZ Corp example, the margin impact would be limited, as the maximum loss is known and contained within the structure of the trade.

Benefits and Risks of Long Put Butterflies

This strategy offers defined risk, potential for profit in a stable market, and lower margin requirements. However, it also has limited profit potential and can be less effective in a volatile market.

Proven Tips for Success with Long Put Butterflies

Success with Long Put Butterflies hinges on precise execution, market timing, and thorough understanding of the underlying asset. Traders should focus on stable markets and be mindful of commission costs and expiry dates.

Real-Life Long Put Butterfly Examples

In our XYZ Corp scenario, a trader would benefit if the stock remains near $100 at expiry. This real-life example underscores the strategy’s effectiveness in a market exhibiting minimal price movement.

When and Why Traders Use Long Put Butterflies

Traders often deploy Long Put Butterflies in markets with low volatility. The goal is to profit from stability in the underlying asset’s price. They are typically used when minimal movement is anticipated.

How do Long Put Butterflies Work?

This strategy involves three different strike prices, creating a profit and loss range that is both limited and predetermined. The ideal scenario is for the underlying asset to be at the middle strike price at expiration.

Are Long Put Butterflies Risky?

While the Long Put Butterfly limits potential loss, it’s not without risk. The strategy requires precise market assessment and timing, with limited potential for profit.

Are Long Put Butterflies Bearish or Bullish?

Long Put Butterflies are generally considered a neutral strategy, as they benefit from minimal movement in the underlying asset’s price.

Conclusion

Mastering the Long Put Butterfly is crucial for traders seeking to profit in stable markets. This strategy’s defined risk and reward parameters make it a unique tool in options trading. For further assistance, traders are encouraged to reach out on X.com or Discord for more support.