Put Broken Wing Butterfly

Introduction to the Put Broken Wing Butterfly

In the dynamic world of options trading, the Put Broken Wing Butterfly emerges as a distinct and strategic approach. Often referred to as a skewed butterfly or a broken wing butterfly put, this strategy is a variation of the traditional butterfly spread. Its unique structure allows traders to capitalize on specific market conditions while maintaining a controlled risk profile.

Key Takeaways

- Put Broken Wing Butterfly is a controlled-risk strategy in options trading.

- It involves a combination of buying and selling puts at different strike prices.

- Ideal in moderately bullish market conditions.

- Commissions and fees are significant due to multiple legs in the trade.

- Requires careful monitoring and adjustment based on market movements.

- Provides a balance of profit potential and risk management.

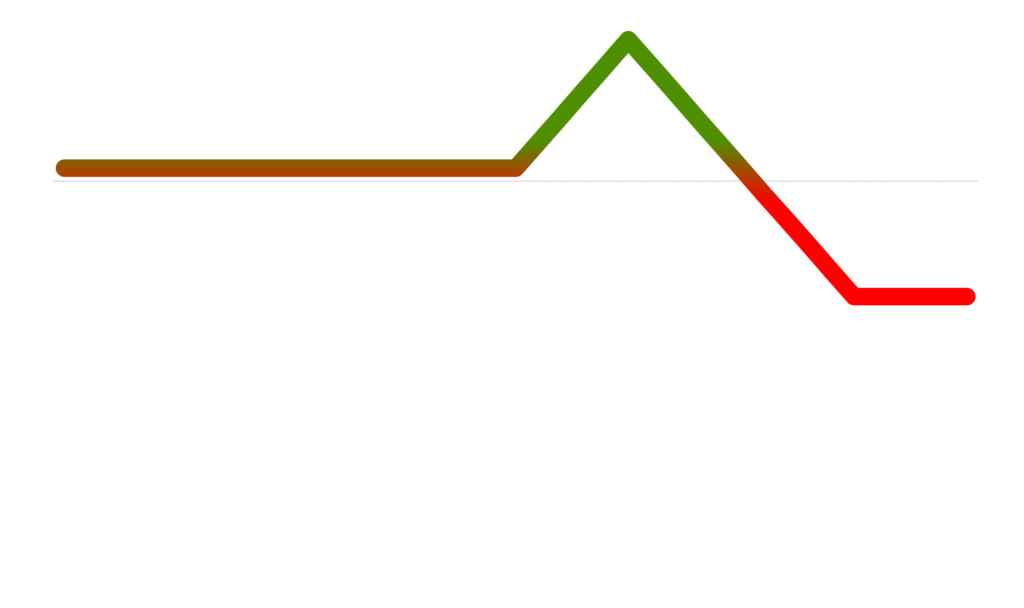

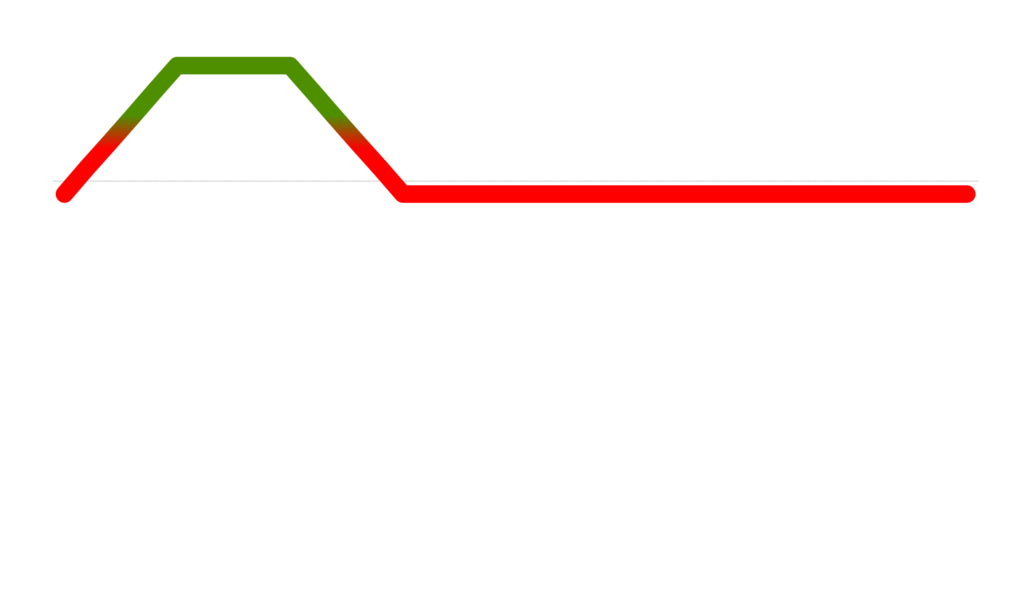

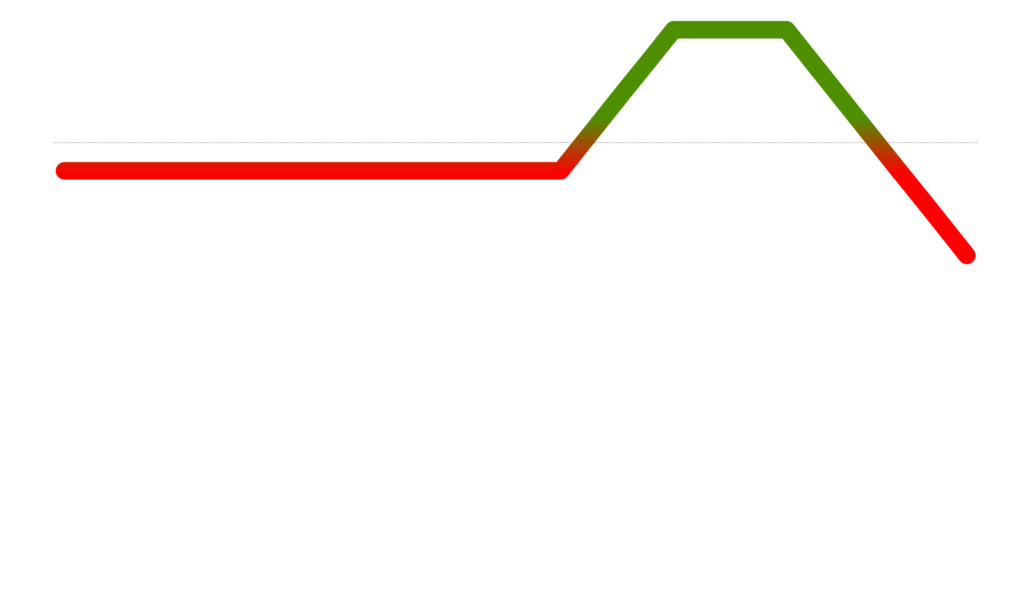

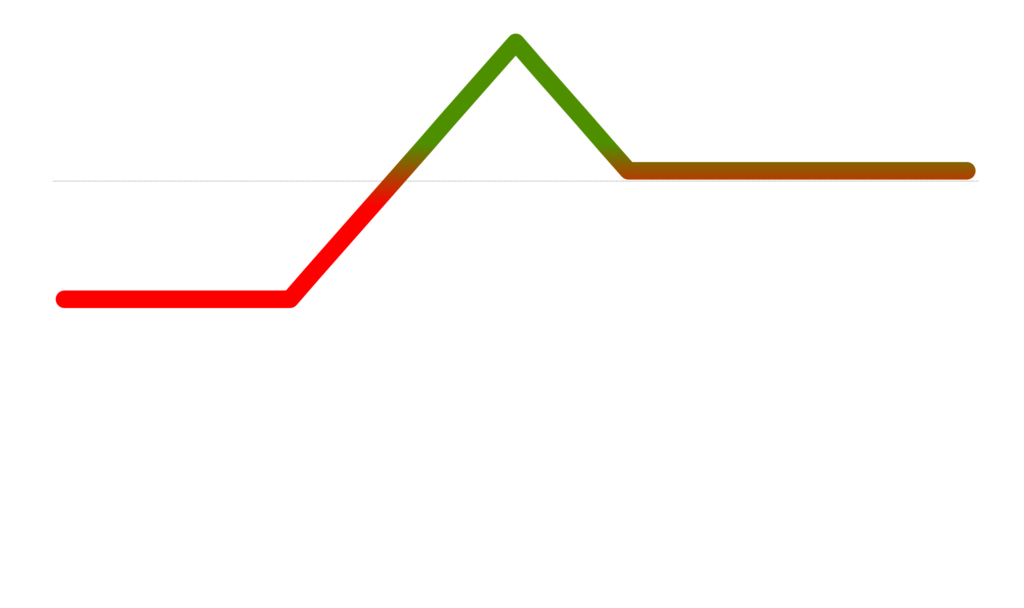

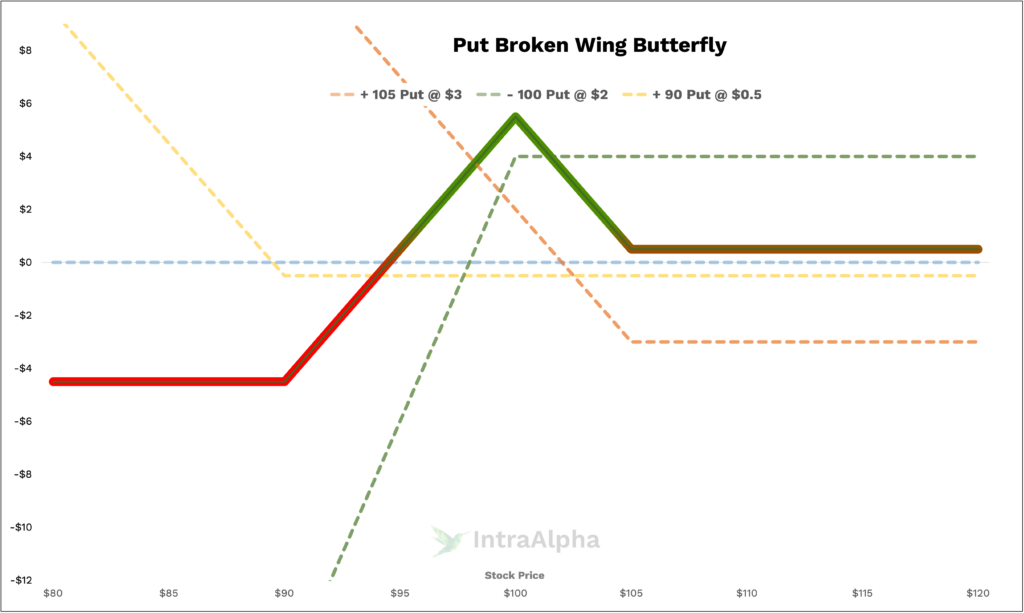

Put Broken Wing Butterfly Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Put Broken Wing Butterflys

At its core, the Put Broken Wing Butterfly involves using both calls and puts to create a non-symmetrical spread with limited risk. The strategy typically includes buying one in-the-money put, selling two at-the-money puts, and buying one out-of-the-money put. This structure aims to benefit from a slight directional move in the underlying asset while protecting against significant adverse moves.

Long Put Broken Wing Butterfly Trades

Let’s consider a practical example with XYZ Corp, currently trading at $100. A trader might execute a 45-day Put Broken Wing Butterfly by:

- Buying a $105 put

- Selling two $100 puts

- Buying a $90 put

The wider distance between the lower strike puts ($90 vs. $95) offers a greater margin for the stock price to fall before the position starts to incur significant losses. This adjustment makes the strategy more resilient to unexpected market movements.

Commissions and Fees with Put Broken Wing Butterflys

Relative to other options strategies, the Put Broken Wing Butterfly can be cost-effective, yet the multiple legs involved mean higher commission fees. Assuming a $1 fee per leg, a round trip trade incurs $8 in total commissions. For our XYZ Corp example, these fees constitute about 5% of the total trade value, a significant factor in assessing the overall profitability of the strategy.

Margin Impact of Put Broken Wing Butterfly

In the XYZ Corp example, the margin requirement is influenced by the short puts. Traders must maintain sufficient margin to cover potential losses, especially due to the asymmetric nature of the spread. This requirement can tie up capital, limiting the ability to execute other trades.

Benefits and Risks of Put Broken Wing Butterfly

The primary advantage of this strategy is its ability to generate profits from a moderately bullish move in the underlying stock while limiting downside risk. However, it’s crucial to understand the risks, particularly the potential for losses if the stock moves significantly away from the target strike prices.

Proven Tips for Success with Put Broken Wing Butterfly

Success with the Put Broken Wing Butterfly strategy hinges on precise execution and timing. Traders should focus on underlying assets with predictable volatility and be ready to adjust positions in response to market movements. Monitoring and experience play a key role in refining this strategy.

Real-Life Put Broken Wing Butterfly Examples

Returning to our XYZ Corp example, a successful Put Broken Wing Butterfly trade would see XYZ’s stock slightly decline, allowing the trader to capitalize on the premium collected while minimizing losses on the short puts. Real-life application of this strategy requires careful monitoring and a willingness to adjust as market conditions change.

When and Why Traders Use Put Broken Wing Butterflys

Traders opt for the Put Broken Wing Butterfly in moderately bullish market conditions. The goal is to benefit from a decline in the underlying asset’s price, ideally landing near the middle strike at expiration. Timing and market sentiment are crucial factors in deciding when to employ this strategy.

How do Put Broken Wing Butterfly Work?

The mechanics of the Put Broken Wing Butterfly involve creating a spread that profits from a specific range of movement in the underlying asset while maintaining a defined risk. The asymmetric structure allows for flexibility and tailored risk management.

Are Put Broken Wing Butterfly Risky?

While the Put Broken Wing Butterfly limits downside risk compared to some strategies, it’s not without risks. The greatest risk arises if the underlying asset moves significantly beyond the anticipated range, potentially leading to losses.

Are Put Broken Wing Butterfly Bearish or Bullish?

This strategy is primarily bullish, as it profits from a slight increase in the underlying asset’s price. However, its structure also provides some protection against bearish movements, making it a nuanced choice for traders.

Conclusion

Mastering the Put Broken Wing Butterfly in options trading requires an understanding of its mechanics, risks, and appropriate market conditions. This strategy offers a unique way to capitalize on specific market movements while controlling risk. For further assistance in navigating Put Broken Wing Butterfly trades, message us on X.com or join our Discord community for more support.