Put Ratio Backspread

Introduction to the Put Ratio Backspread

The Put Ratio Backspread is a significant strategy in the realm of options trading, known for its unique approach to market bearishness. Commonly referred to as simply the ‘Ratio Backspread,’ this technique involves buying a higher number of put options than sold, typically at a lower strike price.

Key Takeaways

- The Put Ratio Backspread is used in bearish market scenarios.

- It involves buying more put options than sold, usually at a lower strike price.

- The strategy aims for high gains in a significant market downturn but carries substantial risks.

- Success requires understanding market trends, option pricing, and managing the position actively.

- The strategy is more costly in terms of commissions and fees due to multiple transactions.

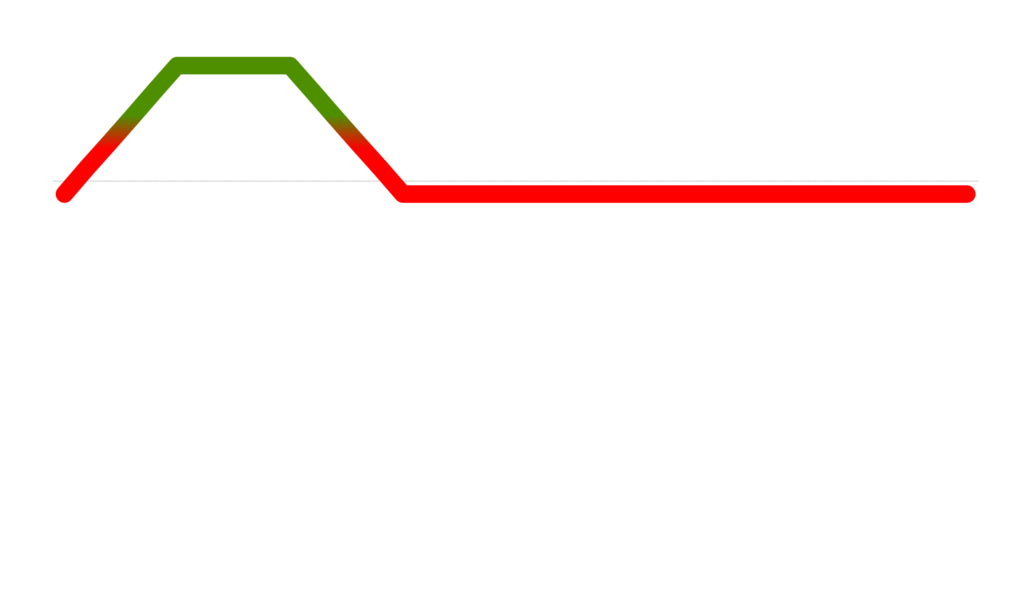

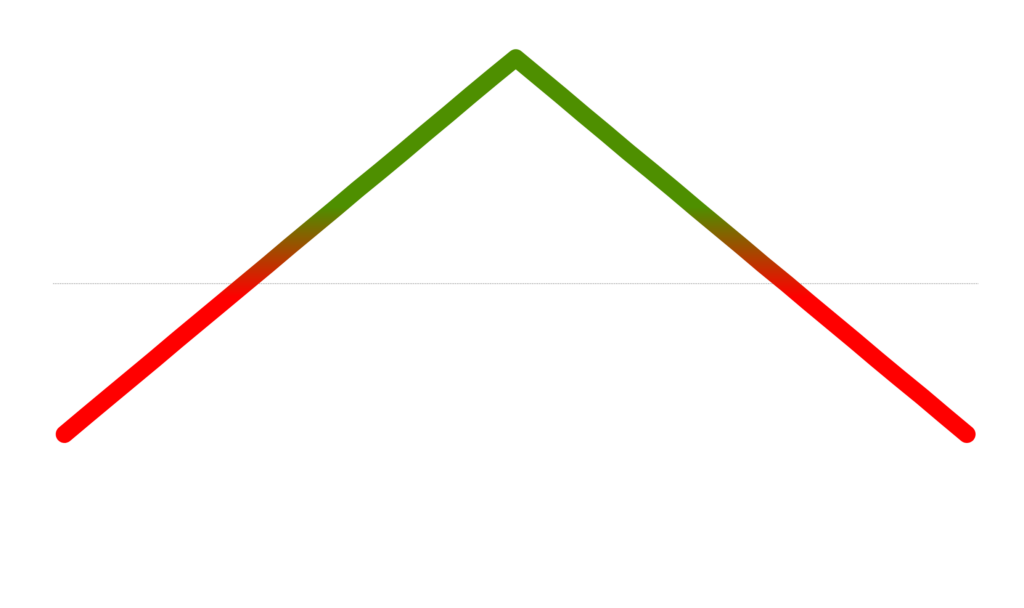

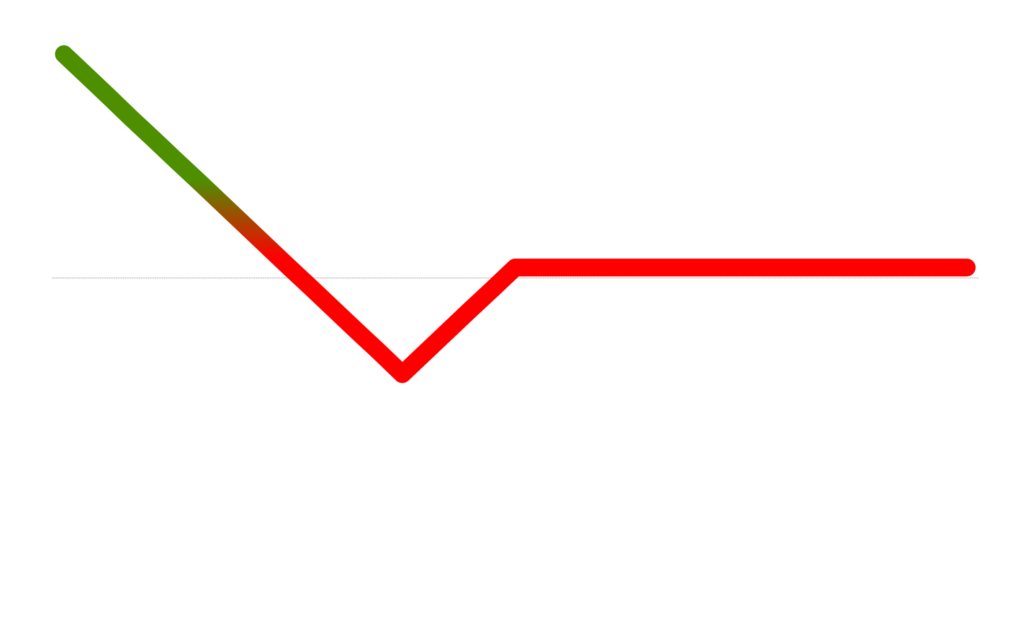

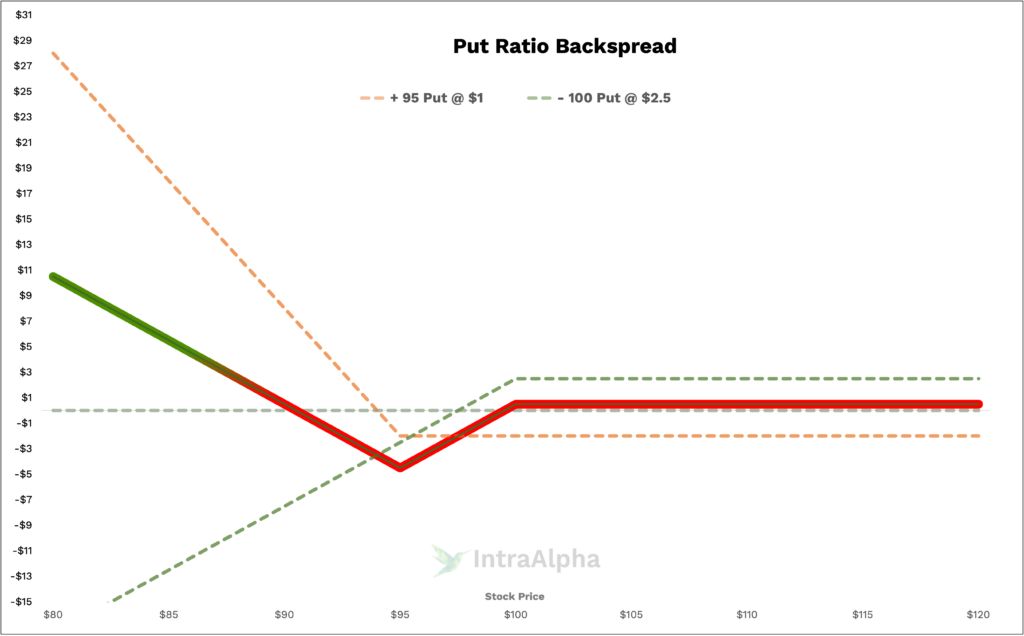

Put Ratio Backspread Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Put Ratio Backspreads

At its core, the Put Ratio Backspread strategy involves buying and selling put options at different strike prices at the same expiration. This strategy is employed when a trader expects a significant move in the underlying stock, usually downwards. It combines long and short positions in puts to create a position that can profit from significant downward movements.

Long Put Ratio Backspread Trades

Executing a long Put Ratio Backspread might involve, for instance, buying two put options of XYZ corp with a strike price of $95 and selling one put option with a strike price of $100, all expiring in 45 days. Suppose XYZ is currently trading at $100. If the total premium collected is $50, this reflects the strategy’s cost-benefit balance. The precise premium depends on market conditions and option pricing factors.

Commissions and Fees with Put Ratio Backspreads

The cost and fees of the Put Ratio Backspread can be relatively higher due to multiple transactions. If each leg costs $1 in fees, a round-trip trade involving three legs totals $6 in commission. This cost is a significant percentage of the total trade value, especially for small trade sizes. Using the XYZ corp example, if the total trade value is $50, the commission represents 12% of the trade value.

Margin Impact of Put Ratio Backspreads

The margin requirement for a Put Ratio Backspread can be substantial as it involves multiple options positions. In our XYZ corp example, the margin would be affected by the short put position at $100. The broker’s margin requirements, based on the risk profile of the trade, determine the exact margin impact.

Benefits and Risks of Put Ratio Backspreads

This strategy offers the potential for unlimited profits if the stock plummets, with a limited risk if the stock price increases. However, the complexity and margin requirements pose significant risks. Traders must be aware of the potential for losses, especially in volatile market conditions.

Proven Tips for Success with Put Ratio Backspreads

Successful trading with Put Ratio Backspreads requires a deep understanding of market trends and options pricing. It’s crucial to choose the right strike prices and expiration dates. Monitoring market conditions and being ready to adjust the position as needed is also essential for success.

Real-Life Put Ratio Backspread Examples

In the XYZ corp example, if the stock price falls significantly below $95, the value of the long puts increases significantly, while the loss on the short put is limited to the difference in strike prices minus the premium received. Conversely, if the stock price remains above $100, the profit is limited to the premium collected.

When and Why Traders Use Put Ratio Backspreads

Traders typically employ Put Ratio Backspreads in bearish market conditions or when a significant downward price movement is anticipated. The strategy aims to capitalize on these movements with limited risk if the expected move does not materialize.

How do Put Ratio Backspreads Work?

The mechanics of the Put Ratio Backspread involve balancing the purchase of a higher number of put options with the sale of a smaller number of put options at a higher strike price. This creates a net credit position that benefits from a significant drop in the underlying stock’s price.

Are Put Ratio Backspreads Risky?

While the Put Ratio Backspread limits risk on the upside, it can still incur significant losses if the stock price doesn’t move as expected. The strategy’s risk is closely tied to its reward potential, requiring careful management.

Are Put Ratio Backspreads Bearish or Bullish?

Put Ratio Backspreads are fundamentally bearish strategies. They are designed to profit from a significant decline in the underlying stock’s price.

Conclusion

Mastering the Put Ratio Backspread in options trading offers traders a sophisticated tool to capitalize on bearish market sentiments. While it presents unique opportunities, understanding its intricacies and risks is crucial. For further assistance in navigating Put Ratio Backspread trades, message us on X.com or join our Discord for more support.