Call Ratio Backspread

Introduction to the Call Ratio Backspread

The Call Ratio Backspread is a sophisticated options trading strategy, primarily used in bullish market scenarios. It’s also known colloquially as “Call Ratio Spread” or “Backspread.” This strategy involves buying more call options than the number of call options sold, typically at a higher strike price.

Key Takeaways

- Call Ratio Backspread is a bullish strategy involving more bought calls than sold.

- Ideal for markets where a significant upward movement in stock prices is expected.

- Involves higher commissions and fees due to multiple transactions.

- Requires a substantial margin and capital.

- Offers unlimited profit potential but also significant risks.

- Success depends on accurate market timing and analysis.

- Used in bullish market conditions for potentially higher rewards.

- Risk and reward must be carefully balanced.

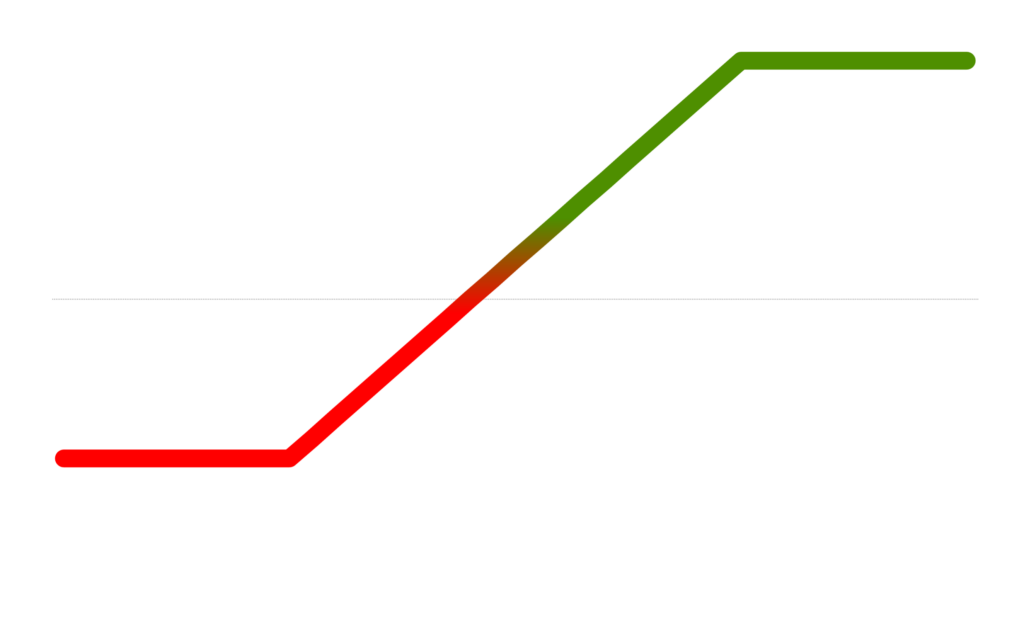

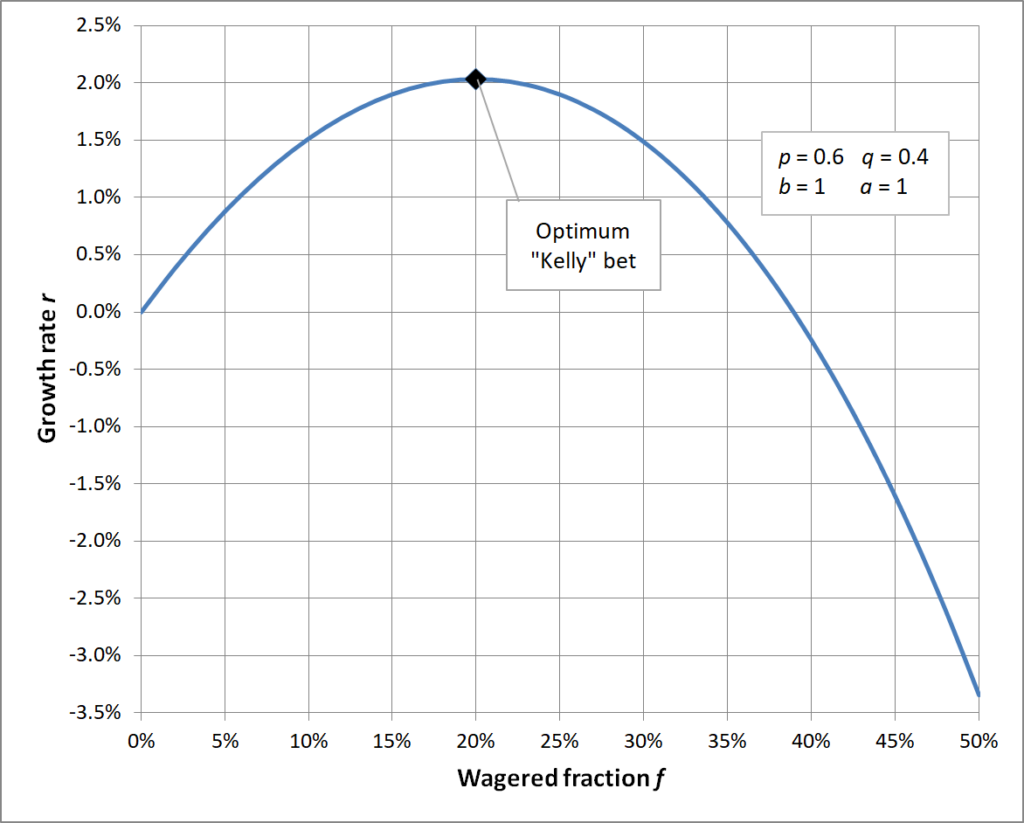

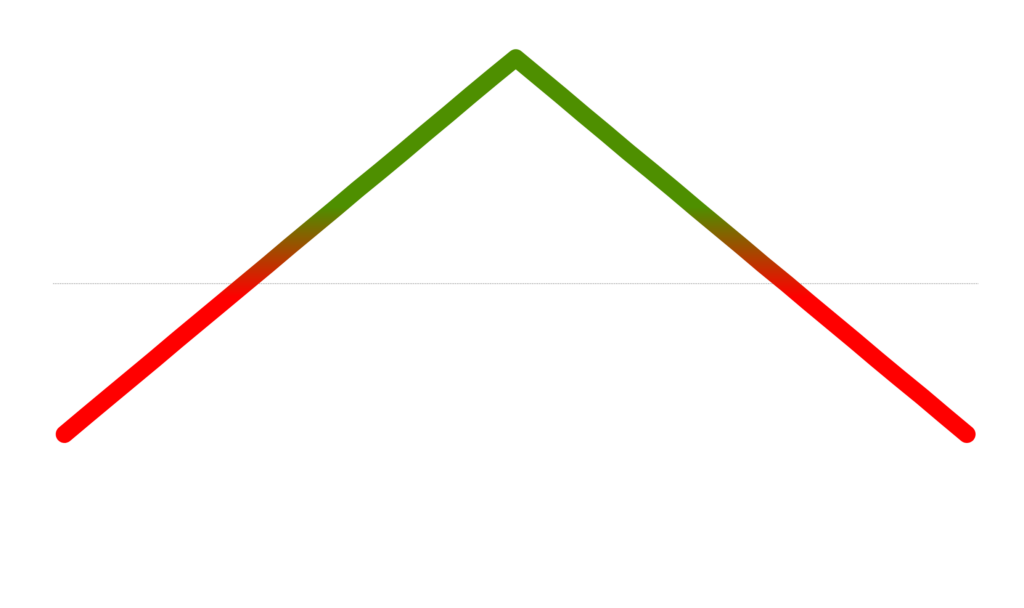

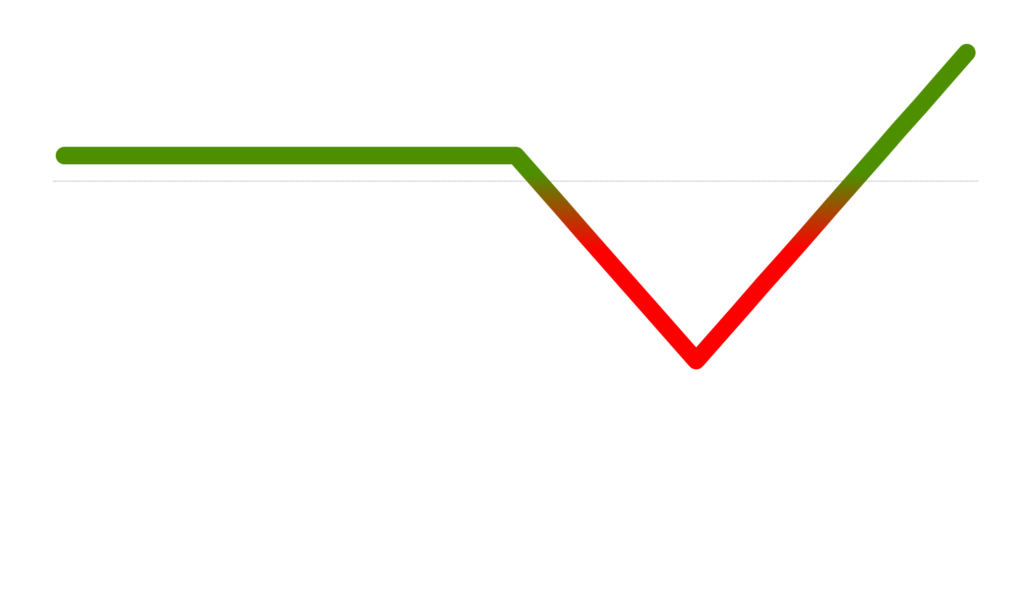

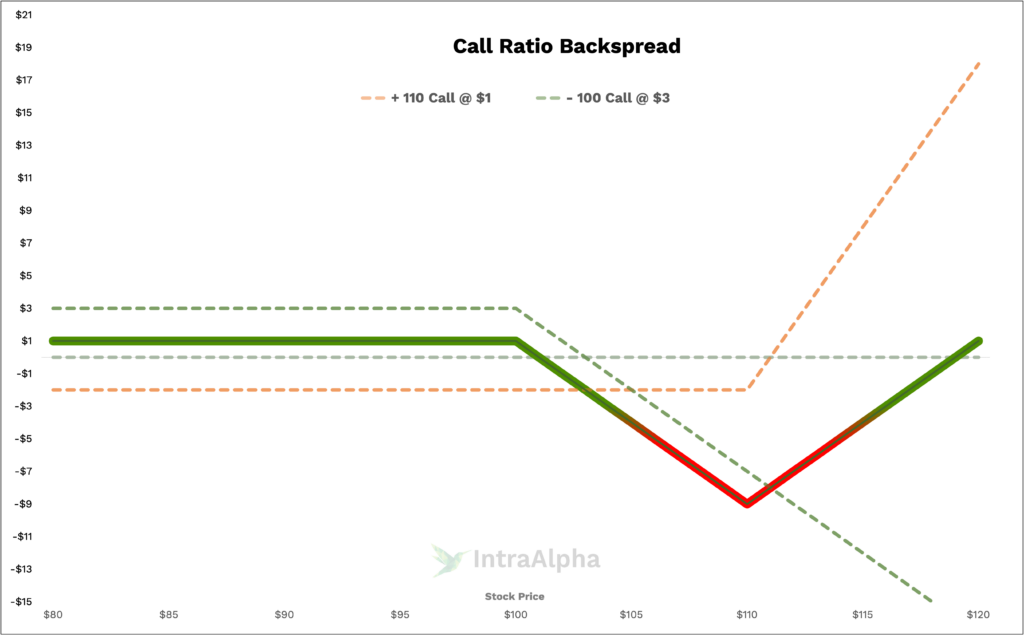

Call Ratio Backspread Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Call Ratio Backspreads

A Call Ratio Backspread is initiated by selling one call option and buying a greater number of call options at a higher strike price. This structure is chosen when a trader expects a significant upward movement in the underlying stock’s price. It differs from typical spreads because it is net long on options, and the risk and reward profile is asymmetrical.

Long Call Ratio Trades

In a practical scenario, consider XYZ Corp trading at $100. To execute a Long Call Ratio Backspread, you might sell one call option with a strike price of $100 expiring in 45 days, and buy two call options with a strike price of $110. If the premium collected from selling the $100 strike call is $300, and the cost of each $110 strike call is $100, your total premium collected is $100.

Commissions and Fees with Call Ratio Backspreads

Commissions and fees can vary, but typically, Call Ratio Backspreads are more expensive due to multiple transactions. Assume each leg incurs a $1 fee; for our XYZ Corp example, the total cost would be $6. This represents a significant percentage of the total cost of the trade, especially in smaller positions.

Margin Impact of Call Ratio Backspreads

Margin requirements can be substantial since the strategy involves net long options. For XYZ Corp at $100, the margin requirement could be a percentage of the underlying stock value, often requiring significant capital.

Benefits and Risks of Call Ratio Backspreads

This strategy offers unlimited profit potential if the stock price rises significantly. However, the risk is also substantial if the stock price falls or remains stagnant, as the premium spent on long calls might be lost.

Proven Tips for Success with Call Ratio Backspreads

Success with Call Ratio Backspreads often depends on accurate market analysis and timing. It’s essential to have a bullish outlook on the underlying stock and to be prepared for potential losses.

Real-Life Call Ratio Backspread Examples

Using the XYZ Corp example, if the stock price rises above $110, the strategy becomes profitable. However, if it remains below $100, the trader incurs a loss equal to the net premium spent.

When and Why Traders Use Call Ratio Backspreads

Traders use Call Ratio Backspreads in bullish markets, expecting significant stock price increases. They are used when traders are moderately bullish and willing to take on more risk for potentially higher rewards.

How do Call Ratio Backspreads Work?

This strategy works by capitalizing on significant stock price movements. If the stock price rises above the higher strike price, profits can be substantial, but if it doesn’t, the losses are limited to the net premium paid.

Are Call Ratio Backspreads Risky?

Yes, they are risky. The strategy offers high reward potential but also carries a significant risk if the stock price does not move as anticipated.

Are Call Ratio Backspreads Bearish or Bullish?

Call Ratio Backspreads are inherently bullish. They are designed to profit from a significant upward move in the underlying stock price.

Conclusion

Mastering the Call Ratio Backspread can be a valuable skill for advanced options traders. It offers high rewards but also carries substantial risks. For more support, message us on X.com or Discord.