Short Put Butterfly

Mastering the Short Put Butterfly in Options Trading

Introduction to the Short Put Butterfly

The Short Put Butterfly is a nuanced and effective strategy in the realm of options trading. Also known as the Put Butterfly Spread, this approach combines both buying and selling put options to create a position that is neutral and benefits from non-movement or slight movement in the underlying asset’s price.

Key Takeaways

- The Short Put Butterfly is a neutral strategy combining bought and sold puts.

- It benefits from limited risk and known potential gains and losses.

- Ideal in low-volatility markets expecting minimal price movement.

- Requires careful position management and understanding of market dynamics.

- Offers a controlled way to generate income from options trading.

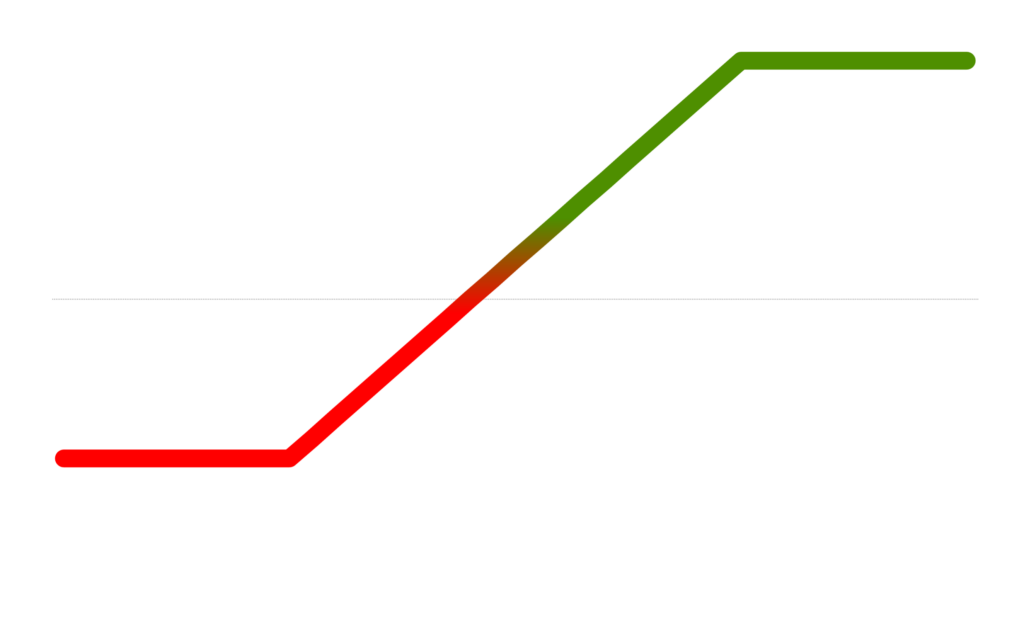

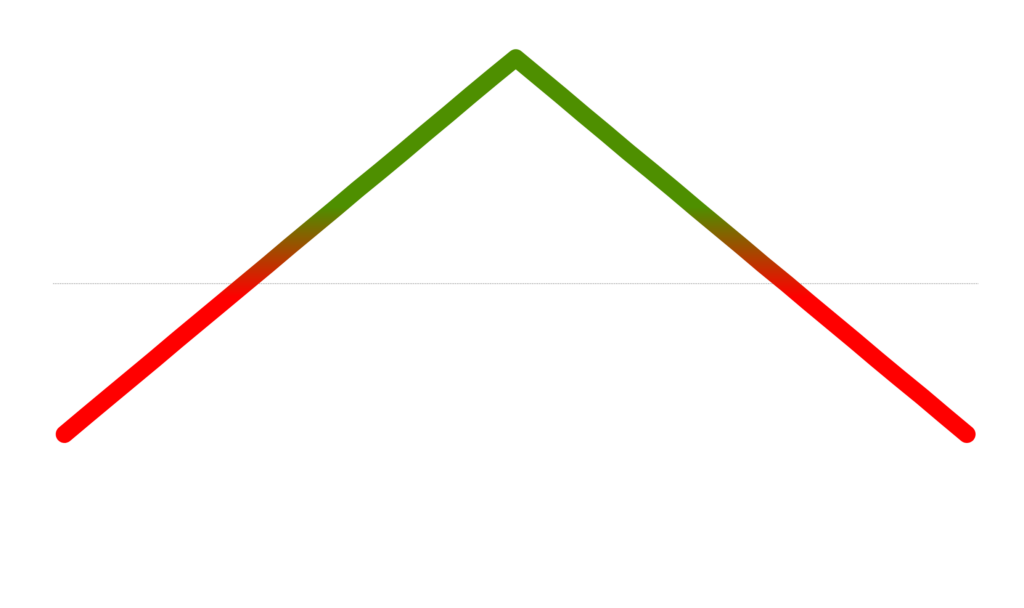

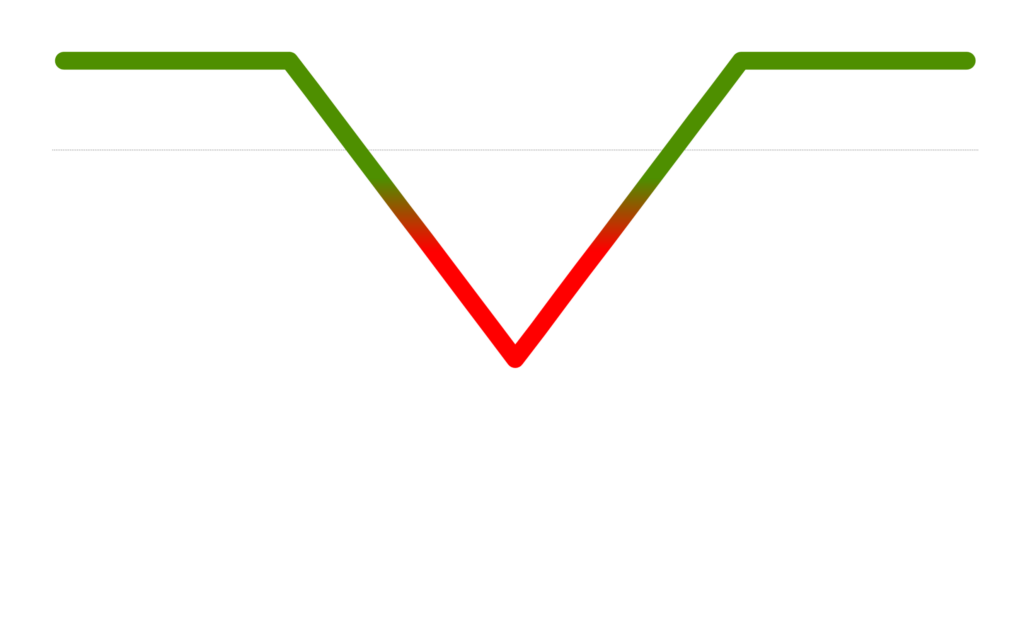

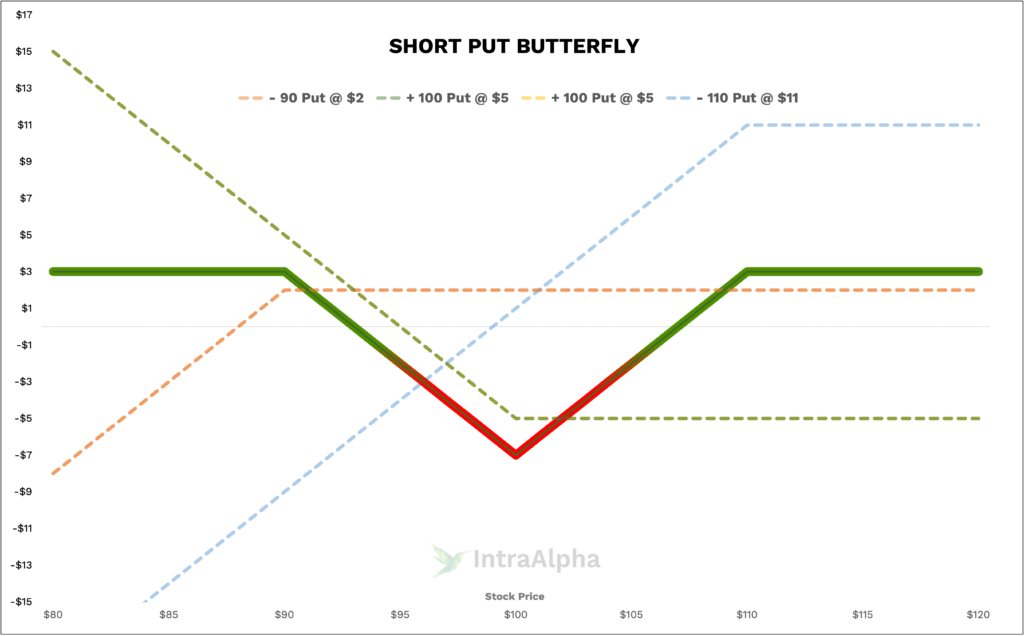

Short Put Butterfly Profit and Loss Diagram

Let’s plot this strategy so we can visually see how the trade P/L performs (y axis), at expiration, given a particular stock price (x axis).

Understanding Short Put Butterflies

At its core, the Short Put Butterfly involves three key components: buying one in-the-money (ITM) put, selling two at-the-money (ATM) puts, and buying one out-of-the-money (OTM) put. All options must have the same expiration date and be centered around the current price of the underlying asset.

Long Short Put Butterfly Trades

Implementing a Long Short Put Butterfly trade with XYZ Corp, assume the stock is trading at $100. The trader might buy one $105 put, sell two $100 puts, and buy one $95 put, all expiring in 45 days. The premium collected could total $300, assuming a max loss potential of $1000 in this scenario. This premium is the trader’s income if XYZ trades near $100 at expiration.

Commissions and Fees with Short Put Butterflies

Trading Short Put Butterflies can be relatively cost-effective. Assuming each leg incurs a $1 fee, a round trip trade (entering and exiting the position) would cost $8 in total. For our XYZ Corp example, the fees would constitute 2.7% of the total trade value ($300 premium on a $1000 max loss trade).

Margin Impact of Short Put Butterflies

Using XYZ Corp as an example, the margin requirement would be the maximum potential loss of the trade minus the premium collected. If XYZ is at $100 and the max loss is $1000 with a $300 premium collected, the margin requirement would be $700.

Benefits and Risks of Short Put Butterflies

This strategy benefits from limited risk and predictable maximum loss and gain. However, the risks include potential losses if the underlying asset moves significantly away from the strike price of the ATM puts.

Proven Tips for Success with Short Put Butterflies

Success with Short Put Butterflies often involves careful monitoring of market conditions, choosing the right expiration dates, and being ready to adjust positions as needed.

Real-Life Short Put Butterfly Examples

In our XYZ Corp example, if the stock price remains near $100 at expiration, the trader realizes the full premium. If the stock moves significantly away from $100, the position might need adjustments or might incur a loss.

When and Why Traders Use Short Put Butterflies

Traders often deploy this strategy in low-volatility markets when they expect the underlying asset to experience minimal price movement. It’s used to generate income with a controlled and known risk.

How Do Short Put Butterflies Work?

The mechanics of this strategy involve balancing the sold and bought puts to create a neutral position that profits from the stagnation or slight movement of the underlying asset’s price.

Are Short Put Butterflies Risky?

While the risk is limited and known upfront, these trades can still incur losses, particularly if the underlying asset moves significantly in price.

Are Short Put Butterflies Bearish or Bullish?

Short Put Butterflies are generally considered market-neutral, profiting from little to no movement in the underlying asset rather than directional price movements.

Conclusion

The Short Put Butterfly is a complex but rewarding strategy in options trading. It requires a solid understanding of market dynamics and careful position management. Mastering this strategy can be a valuable part of a trader’s toolkit. For further assistance, don’t hesitate to message us on X.com or join our Discord for more support.